Question: 2 Alt Ctri 2 (Te xtbook Reference: P10-8)- Evaluate investment proposal using net present value Company is considering purchasing new equipment costing $2.400,000. Jordan estimates

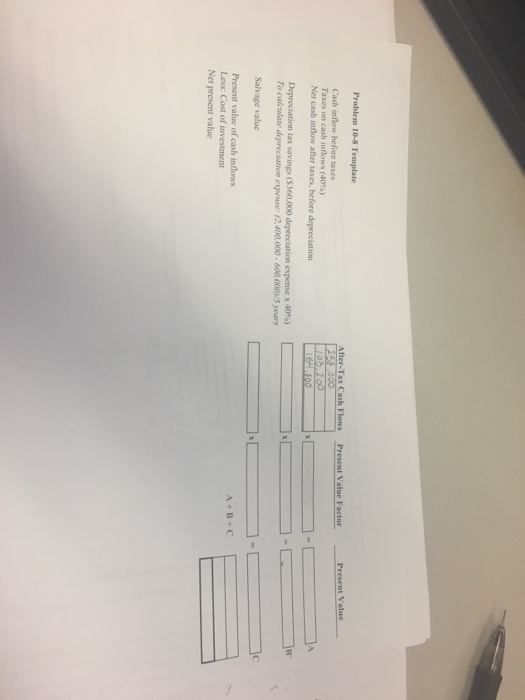

2 Alt Ctri 2 (Te xtbook Reference: P10-8)- Evaluate investment proposal using net present value Company is considering purchasing new equipment costing $2.400,000. Jordan estimates that the useful life of the ouipment will be five years.and that it will have a salvage value of $600,000. The company uses straight-lin ciation. The new equipment is expected to have a net cash inflow (before taxes) of $258,000 annually. Assume that the tax rate s 40% and that management requires a minimum return of 14%. Required: Using the net present value method, determine whether the equipment is an acceptable investment. ***Template provided on next page*** 258 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts