Question: Need this ASAP. roblem 2 (Textbook Reference: P10-8) - Evaluate investment propos al using net present valu Jordan Company is considering purchasing new equipment costing

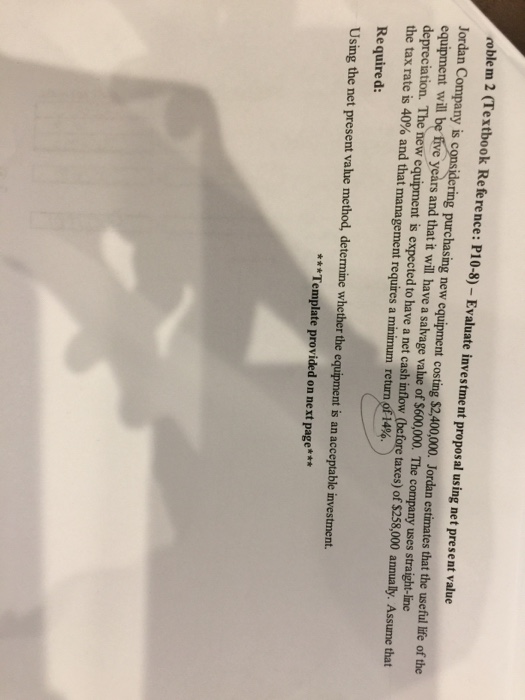

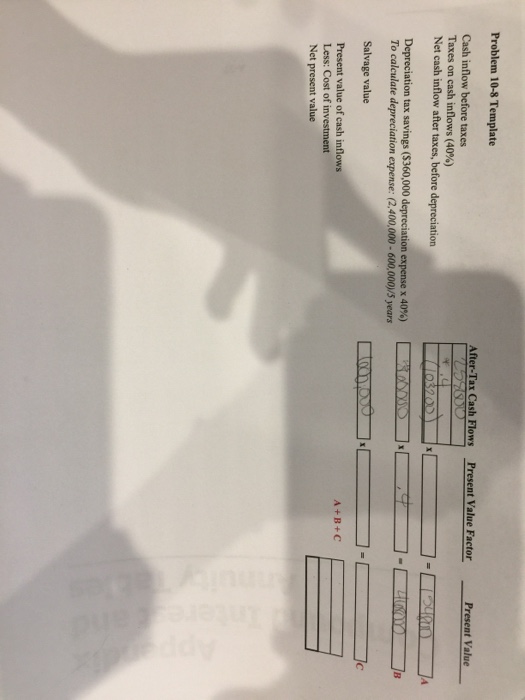

roblem 2 (Textbook Reference: P10-8) - Evaluate investment propos al using net present valu Jordan Company is considering purchasing new equipment costing $2,400,000. Jordan es equipment will be five years depreciation. The the tax rate is 4 and that management requires a minimum return of 14%. timates that the useful life of the and that it will have a salvage value of $600,000. The company uses straight-line new equipment is expected to have a net cash inflow (before taxes) of $258,000 annually. Assume that Required: Using the net present value method, determine whether the equipment is an acceptable investment. ***Template provided on next page***

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts