Question: 2. Although a down-payment (initial margin) of 20% is typical for a home purchase, homebuyers of modest means can qualify for a loan insured by

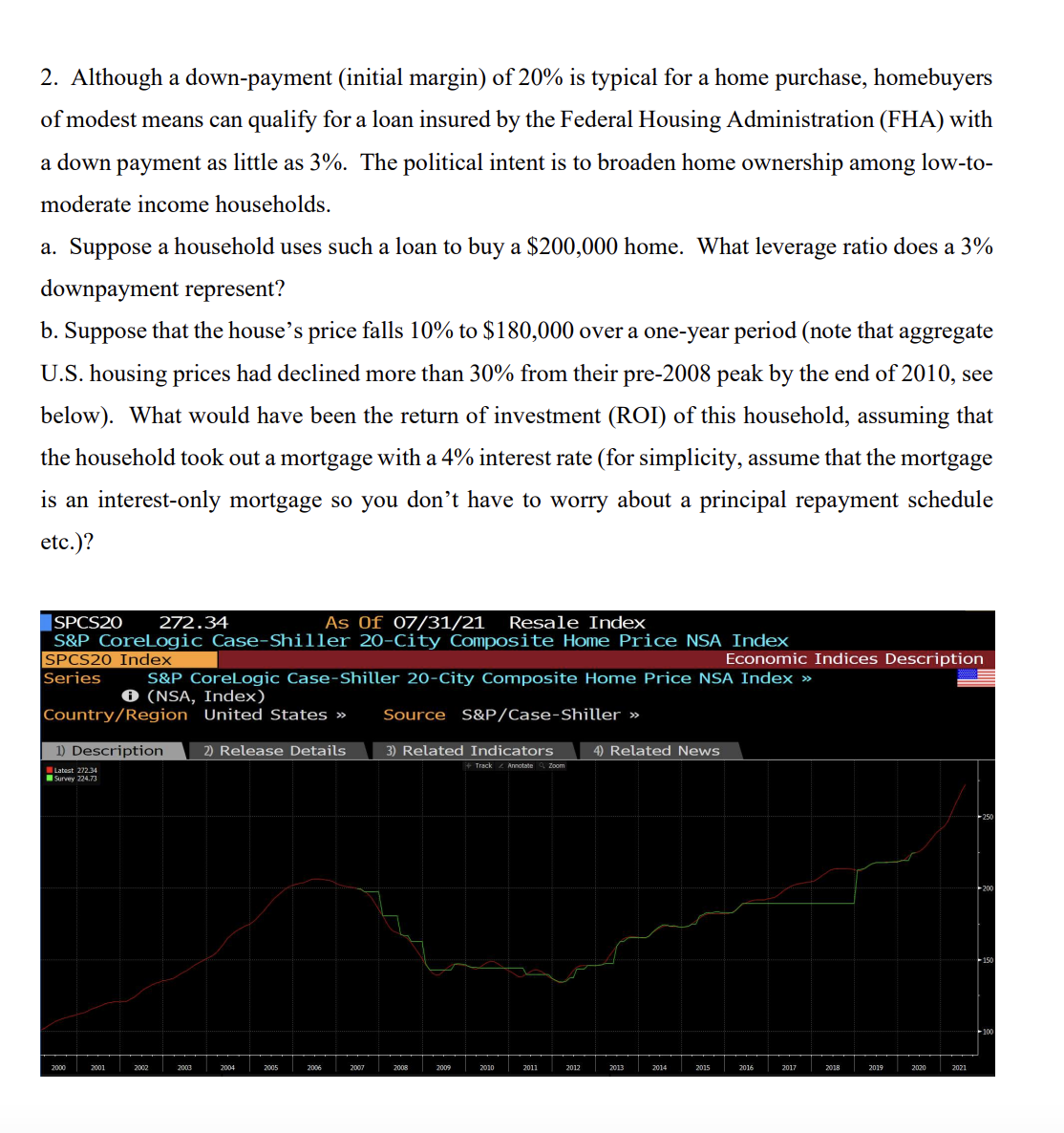

2. Although a down-payment (initial margin) of 20% is typical for a home purchase, homebuyers of modest means can qualify for a loan insured by the Federal Housing Administration (FHA) with a down payment as little as 3%. The political intent is to broaden home ownership among low-tomoderate income households. a. Suppose a household uses such a loan to buy a $200,000 home. What leverage ratio does a 3% downpayment represent? b. Suppose that the house's price falls 10% to $180,000 over a one-year period (note that aggregate U.S. housing prices had declined more than 30% from their pre-2008 peak by the end of 2010 , see below). What would have been the return of investment (ROI) of this household, assuming that the household took out a mortgage with a 4% interest rate (for simplicity, assume that the mortgage is an interest-only mortgage so you don't have to worry about a principal repayment schedule etc.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts