Question: Question 2 Although a down-payment (initial margin) of 20% is typical for a home purchase, homebuyers of modest means can qualify for a loan insured

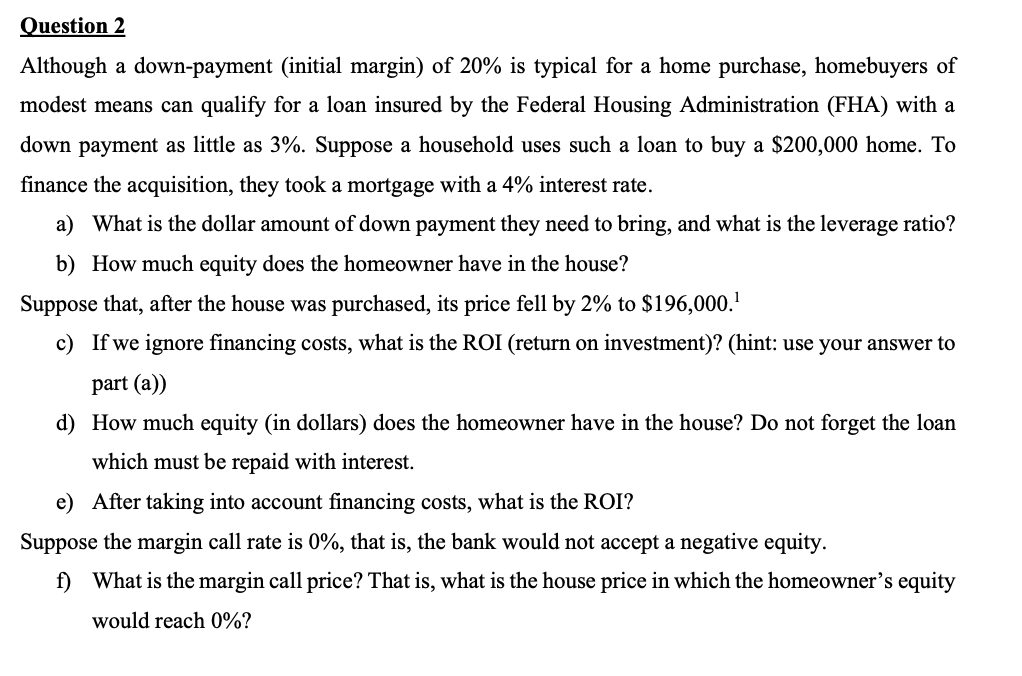

Question 2 Although a down-payment (initial margin) of 20% is typical for a home purchase, homebuyers of modest means can qualify for a loan insured by the Federal Housing Administration (FHA) with a down payment as little as 3%. Suppose a household uses such a loan to buy a $200,000 home. To finance the acquisition, they took a mortgage with a 4% interest rate. a) What is the dollar amount of down payment they need to bring, and what is the leverage ratio? b) How much equity does the homeowner have in the house? Suppose that, after the house was purchased, its price fell by 2% to $196,000.' c) If we ignore financing costs, what is the ROI (return on investment)? (hint: use your answer to part (a)) d) How much equity (in dollars) does the homeowner have in the house? Do not forget the loan which must be repaid with interest. e) After taking into account financing costs, what is the ROI? Suppose the margin call rate is 0%, that is, the bank would not accept a negative equity. f) What is the margin call price? That is, what is the house price in which the homeowner's equity would reach 0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts