Question: 2. An insurance company is backtesting its VaR methodology using data from March 6, 2017 to March 31, 2017 (i.e., a total of 20 daily

2. An insurance company is backtesting its VaR methodology using data from March 6, 2017

to March 31, 2017 (i.e., a total of 20 daily observations).

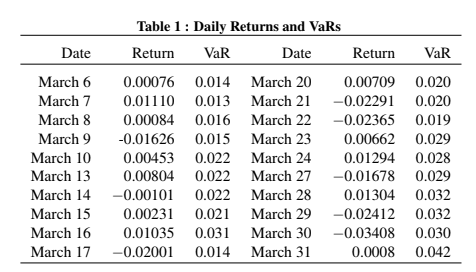

Table 1 shows the daily equity returns of the insurance company and the estimated daily 5%

VaRs over this period.

(a) What is the hit sequence for this 20 observations? ()

(b) Calculate the likelihood ratio statistic for the unconditional coverage test. Would you

reject the null hypothesis with 95% confidence? (Hint: The 95% quantile of ?^2 1 is 3.84)

()

(c) Calculate the likelihood ratio statistic for the independence test. Would you reject the

null hypothesis with 95% confidence? (Hint: The 95% quantile of ?^2 1 is 3.84) ()

Table l : m Rl'nm and 113115 Date Realm Val! Date Return VaR March 6 1111111136 11.1114 March 213 11.111.11'1151I 13.13211 March 3' 13.111 1 113 11.1313 March 21 41.112291 13.13111 March 3 1311111134 11.1116 March 22 41.112365 13.1319 March 9 43111626 11.1115 March 23 11.111166! 13.13151 March 111 [31111453 11.1322 March 24 11.111294 13.13113 March 13 1111113114 11.1122 March 2? 41.111673 13.1329 March 14 -13.11111111 11.1122 March 28 {1.1113114 13.1332 March 15 131111231 11.1321 March 29 41.112412 13.1332 March 16 111111135 11.1131 March 313 11.1134113 13.13311 March 13' 4111211111 11.1114 March 31 (1.1113113 13.1342

Table l : m Rl'nm and 113115 Date Realm Val! Date Return VaR March 6 1111111136 11.1114 March 213 11.111.11'1151I 13.13211 March 3' 13.111 1 113 11.1313 March 21 41.112291 13.13111 March 3 1311111134 11.1116 March 22 41.112365 13.1319 March 9 43111626 11.1115 March 23 11.111166! 13.13151 March 111 [31111453 11.1322 March 24 11.111294 13.13113 March 13 1111113114 11.1122 March 2? 41.111673 13.1329 March 14 -13.11111111 11.1122 March 28 {1.1113114 13.1332 March 15 131111231 11.1321 March 29 41.112412 13.1332 March 16 111111135 11.1131 March 313 11.1134113 13.13311 March 13' 4111211111 11.1114 March 31 (1.1113113 13.1342

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts