Question: 2. Apply the loss development factors and determine the estimated ultimate losses. Assume the following products liability losses for Hawk Manufacturing Company. Accident Year 18

2. Apply the loss development factors and determine the estimated ultimate losses.

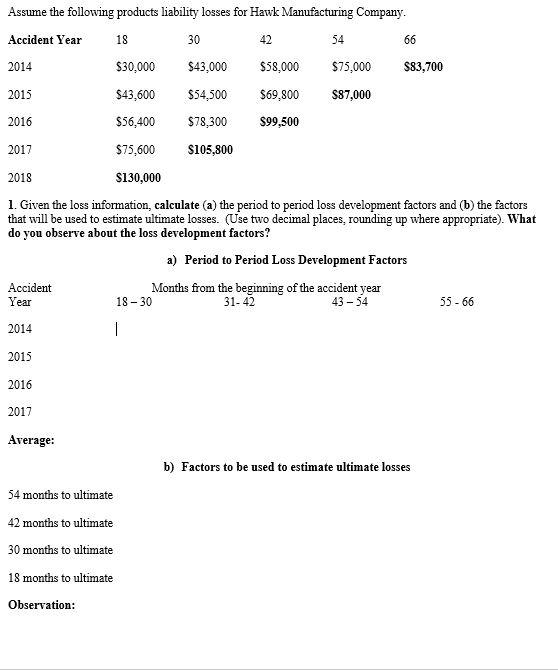

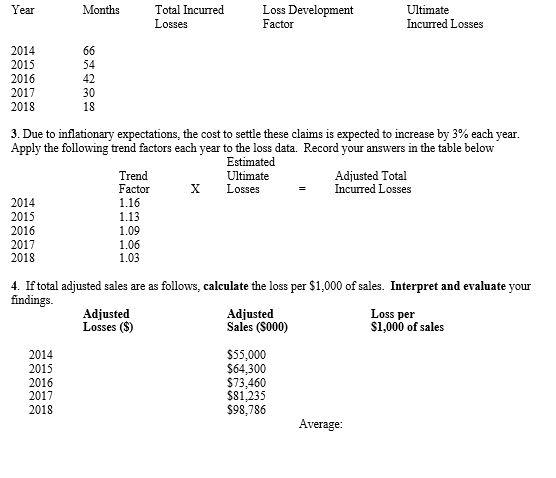

Assume the following products liability losses for Hawk Manufacturing Company. Accident Year 18 30 42 54 66 2014 $30,000 $43,000 $58,000 $75,000 $83,700 2015 $43,600 $54,500 $69,800 $87,000 2016 $56,400 $78,300 $99,500 2017 $75,600 $105,800 2018 $130,000 1. Given the loss information, calculate (a) the period to period loss development factors and (b) the factors that will be used to estimate ultimate losses. (Use two decimal places, rounding up where appropriate). What do you observe about the loss development factors? a) Period to Period Loss Development Factors Accident Months from the beginning of the accident year Year 18-30 31-42 43 - 54 2014 1 55-66 2015 2016 2017 Average: b) Factors to be used to estimate ultimate losses 54 months to ultimate 42 months to ultimate 30 months to ultimate 18 months to ultimate Observation: Factor Year Months Total Incurred Loss Development Ultimate Losses Incurred Losses 2014 66 2015 54 2016 42 2017 30 2018 18 3. Due to inflationary expectations, the cost to settle these claims is expected to increase by 3% each year. Apply the following trend factors each year to the loss data. Record your answers in the table below Estimated Trend Ultimate Adjusted Total Factor x Losses Incurred Losses 2014 1.16 2015 1.13 2016 1.09 2017 1.06 2018 1.03 4. If total adjusted sales are as follows, calculate the loss per $1,000 of sales. Interpret and evaluate your findings. Adjusted Adjusted Loss per Losses ($) Sales (5000) $1,000 of sales 2014 $55,000 2015 $64,300 2016 $73,460 2017 $81.235 2018 $98,786 Average: Assume the following products liability losses for Hawk Manufacturing Company. Accident Year 18 30 42 54 66 2014 $30,000 $43,000 $58,000 $75,000 $83,700 2015 $43,600 $54,500 $69,800 $87,000 2016 $56,400 $78,300 $99,500 2017 $75,600 $105,800 2018 $130,000 1. Given the loss information, calculate (a) the period to period loss development factors and (b) the factors that will be used to estimate ultimate losses. (Use two decimal places, rounding up where appropriate). What do you observe about the loss development factors? a) Period to Period Loss Development Factors Accident Months from the beginning of the accident year Year 18-30 31-42 43 - 54 2014 1 55-66 2015 2016 2017 Average: b) Factors to be used to estimate ultimate losses 54 months to ultimate 42 months to ultimate 30 months to ultimate 18 months to ultimate Observation: Factor Year Months Total Incurred Loss Development Ultimate Losses Incurred Losses 2014 66 2015 54 2016 42 2017 30 2018 18 3. Due to inflationary expectations, the cost to settle these claims is expected to increase by 3% each year. Apply the following trend factors each year to the loss data. Record your answers in the table below Estimated Trend Ultimate Adjusted Total Factor x Losses Incurred Losses 2014 1.16 2015 1.13 2016 1.09 2017 1.06 2018 1.03 4. If total adjusted sales are as follows, calculate the loss per $1,000 of sales. Interpret and evaluate your findings. Adjusted Adjusted Loss per Losses ($) Sales (5000) $1,000 of sales 2014 $55,000 2015 $64,300 2016 $73,460 2017 $81.235 2018 $98,786 Average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts