Question: 2. Arbor Systems and Gencore stocks both have a volatility of 50%. Compute the volatility of a portfolio with 50% invested in each stock if

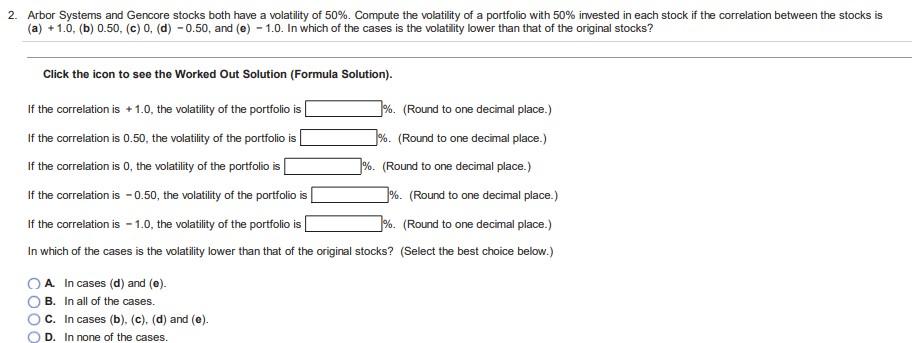

2. Arbor Systems and Gencore stocks both have a volatility of 50%. Compute the volatility of a portfolio with 50% invested in each stock if the correlation between the stocks is (a) +1.0, (b) 0.50, (c) 0, (d) -0.50, and (e) - 1.0. In which of the cases is the volatility lower than that of the original stocks? Click the icon to see the worked Out Solution (Formula Solution). If the correlation is +1.0, the volatility of the portfolio is %. (Round to one decimal place.) If the correlation is 0.50, the volatility of the portfolio is %. (Round to one decimal place.) If the correlation is 0, the volatility of the portfolio is ]%. (Round to one decimal place.) If the correlation is - 0.50, the volatility of the portfolio is ]%. (Round to one decimal place.) If the correlation is -1.0, the volatility of the portfolio is ]%. (Round to one decimal place.) In which of the cases is the volatility lower than that of the original stocks? (Select the best choice below.) OOOO A In cases (d) and (6) B. In all of the cases. C. In cases (b), (c), (d) and (e). D. In none of the cases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts