Question: #2 are rapidly evolving ow do you know if its full value? egy linking metrics or trying out change your omnichannel in the Americas, Europe,

#2

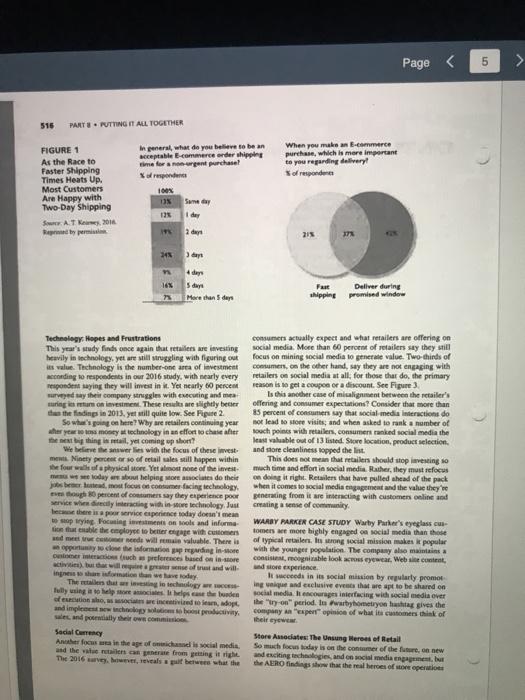

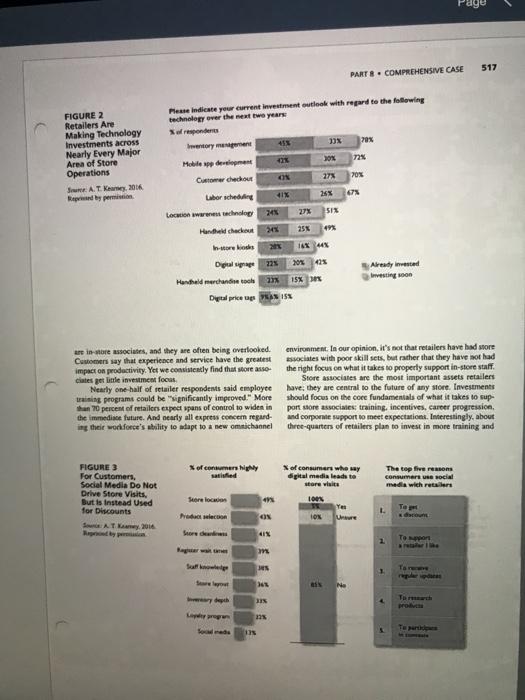

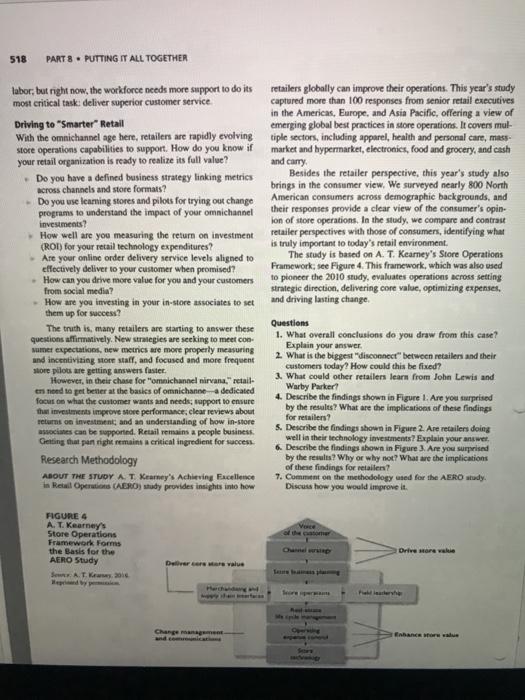

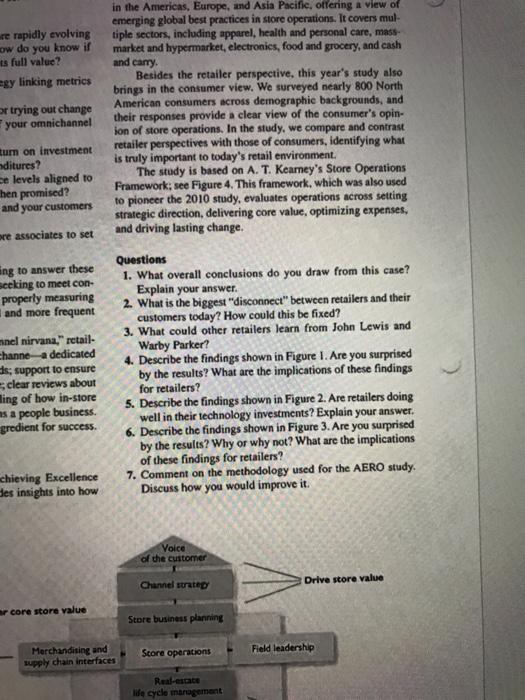

are rapidly evolving ow do you know if its full value? egy linking metrics or trying out change your omnichannel in the Americas, Europe, and Asia Pacific, offering a view of emerging global best practices in store operations. It covers mul- tiple sectors, including apparel, health and personal care, mass- market and hypermarket, electronics, food and grocery, and cash and carry Besides the retailer perspective, this year's study also brings in the consumer view. We surveyed nearly 800 North American consumers across demographic backgrounds, and their responses provide a clear view of the consumer's opin- ion of store operations. In the study, we compare and contrast retailer perspectives with those of consumers, identifying what is truly important to today's retail environment. The study is based on A. T. Kearney's Store Operations Framework: see Figure 4. This framework, which was also used to pioneer the 2010 study, evaluates operations across setting strategic direction, delivering core value, optimizing expenses. and driving lasting change, Zurn on investment ditures? e levels aligned to hen promised? and your customers ore associates to set ing to answer these seeking to meet con- properly measuring and more frequent minel nirvana." retail- Channe a dedicated is; support to ensure clear reviews about ling of how in-store as a people business gredient for success. Questions 1. What overall conclusions do you draw from this case? Explain your answer. 2. What is the biggest "disconnect" between retailers and their customers today? How could this be fixed? 3. What could other retailers learn from John Lewis and Warby Parker? 4. Describe the findings shown in Figure 1. Are you surprised by the results? What are the implications of these findings for retailers? 5. Describe the findings shown in Figure 2. Are retailers doing well in their technology investments? Explain your answer. 6. Describe the findings shown in Figure 3. Are you surprised by the results? Why or why not? What are the implications of these findings for retailers? 7. Comment on the methodology used for the AERO study Discuss how you would improve it. chieving Excellence des insights into how Voice of the customer Channel strategi Drive score value r core store value Store business planning Merchandising and supply chain Interfaces Store operations Field leadership Real-escate life cycle management PARTS . COMPREHENSIVE CASE 51 PART 8 Comprehensive Case Achieving Excellence in Retailing Introduction The 2016 AT Kearney Achieving Excellence in Retail Opera tions (AERO) study uncovers both the good and the bad in this new era of store operations. The good a clear and consistent trend of "smartet" retail, Survey responses from executives at more than 100 global retailers reveal that companies are align ing store operation strategies and metrics to the new omnichan nel environment and are investing heavily in providing support Pilots and trials are evolving more rapidly and more fulfillment options are quickly becoming available across all retail sectors The bad: AERO points to the many challenges retailers face in effectively adopting these smarter strategies and metrics. Although technology is the number one retail investment today. there's limited visibility on the return on investment. Amid the noise of technology investment and omnichannel integration, store associates are often overlooked as crucial conduits for improved store performance. And importantly, the study points to a misalignment between consumer expectations and retailer offerings, with retailers investing in services that customers may not want, need, or expect, particularly in terms of fulfill ment, in-store technology, and social engagement. In seeking to be all things to all people, are retailers driving unnecessary cost and complexity in their operations? The 2016 AERO study probes these key trends in retail today, offers insightful case studies, and shares our thoughts on potential solutions By understanding the new rules of the game, improved retail operations can be a path to success in this new retailers A Smarter Way to Manage Retail Operations Omnichannel has ushered in the next wave of growth in retail But defining what it exactly is depends on who you're talking 1. Is it uniform messaging across channels? Seamless fulfill met cross channels? Consistent pricing across channels? All of the sbove? Regardless of how it is defined, any retailer will tell you that its impacto retail operations has been incredible The AERO findings point to major changes already in place in sos topport omnichannel. Eighty six percent of reasers have signed store regles de metrics to support an Omnichannel av Store associates are being trained on cross platforme engagement, incentivized to sell through E-comic channels and rewarded for in-store fulfillment Training on consumengement, education, and sales is evolving til leaders rethink the stores role in showroom, mini-distributie , education centen, and the like Gone are the days whes son's access was based solely on the revenge pred within the four walls, with more profit and incentive structure refined to includes samuding E-commerce business. This has also fundamentally changed how store associates need to think about their customers. Retailers are also getting smarter about when, where, and how they test their new concepts in stores. In our 2013 survey we found that 19 percent of retailers had an active pilot pro- gram, today, the number is above 30 percent. This year's survey finds some retailers are well down the path to a store operations toolset to be successful. JOHN LEWIS CASE STUDY John Lewis, a 150-year-old U.K. department store, found a smarter way to manage technology and ultimately provide a differentiated service offering to consumers. The success started with several pilot programs. It used online technologies to pilot an "omnichannel store that offered the full assortment of John Lewis products in a smaller format. Its app gave consumers access to 250,000 products, product reviews, price matches, wish lists, and videos. In-store iPads and comput- ers gave consumers access to thousands of products not currently in the store, along with fulfillment options to a home or a store. And a click-and-collect program allowed customers to buy a range of products from John Lewis and other subsidiary brands. from clothing to homewares, online and then collect in one trip John Lewis' offering has proved successful. Today, one- third of sales are from online purchases, worth roughly $1.5 billion, with growth in that channel of 25 percent. Its click and collect orders have reached 6 million per year, a 17-fold increase from 350,000 in 2008, its first year. Aligning Consumer Expectations and Retailer Offerings Despite the wave of exciting activity to support omnichannel. many bets that retailers are placing in store operations aren't necessarily bringing desired results. Our study points to mis alignment between retail offerings and consumer expectation As retailers take leaps forward toward "omnichannel nirvana." consumers are only demanding small steps While we expect expectations to shift as more options become available and known, the findings point to the need for simply getting this basic capability right more than a third of respondents say their company falls short For example, we've also seen the race to near immedi ate shipping times from next day to same-day to one-hour shipping. Despite this focus, more than three-quarter of con tomers wurveyed say they merely expect two days or more for shipping Consumers say they are more interested in retailers fulfilling their promisegning products when they were told they would rather than on getting the product immediately See Fiqet These issues have dramatie implications on retail opers the need for new capabilities, skill sets, and Bols and for workflow and incentives to meet omnichannel expectation The mind opportunity is wherer's offering and the vestments needed to produce il are for separated from cus tomer expectations. What consumers value should underpin channel instalare operations and ot merely Amer's mnichannel in This will help wanne car con complexity demately reduce con condition Bad A DA Adam 2016 Op AEROpen PAre BeAT 2016 - Page

#2

#2