Question: 2. Assume the facts in (a) through (e), below, are independent and relate to the involuntary conversion of business property. Also assume the taxpayer reinvests

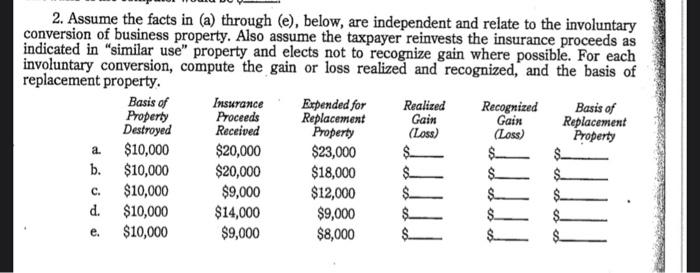

2. Assume the facts in (a) through (e), below, are independent and relate to the involuntary conversion of business property. Also assume the taxpayer reinvests the insurance proceeds as indicated in "similar use" property and elects not to recognize gain where possible. For each involuntary conversion, compute the gain or loss realized and recognized, and the basis of replacement property. Basis of Insurance Expended for Realized Recognized Basis of Property Proceeds Replacement Gain Gain Replacement Destroyed Received Property (Loss) (Loss) Property $10,000 $20,000 $23,000 $ $- b. $10,000 $20,000 $18,000 $ $. $ $10,000 $9,000 $12,000 $_ $ d. $10,000 $14,000 $9,000 $10,000 $9,000 $8,000 a. c. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts