Question: 2. Balance sheet. Reach Manufacturing has lost its computer systems and must reconstruct the last two years of its balance sheet. The company has been

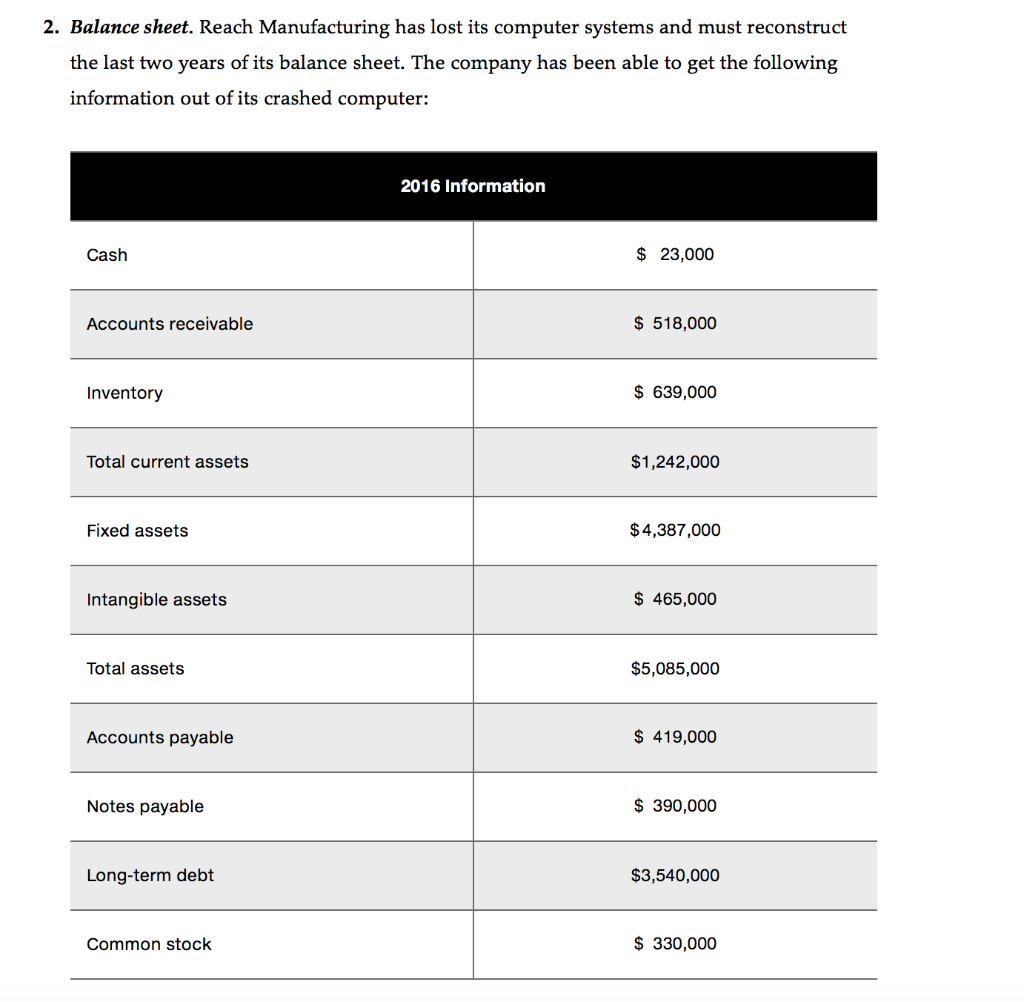

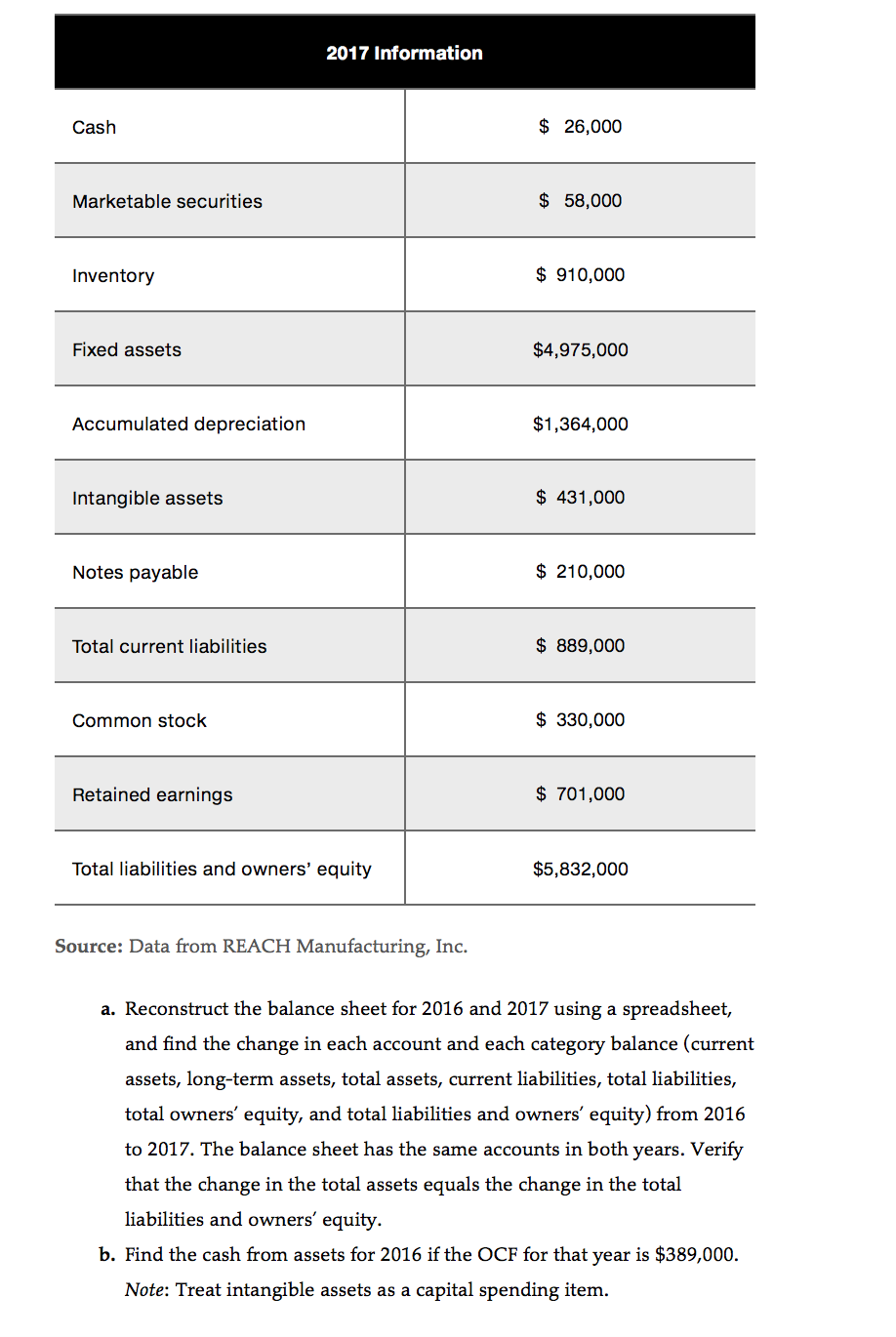

2. Balance sheet. Reach Manufacturing has lost its computer systems and must reconstruct the last two years of its balance sheet. The company has been able to get the following information out of its crashed computer: 2016 Information Cash $ 23,000 Accounts receivable $ 518,000 Inventory $ 639,000 Total current assets $1,242,000 Fixed assets $ 4,387,000 Intangible assets $ 465,000 Total assets $5,085,000 Accounts payable $ 419,000 Notes payable $ 390,000 Long-term debt $3,540,000 Common stock $ 330,000 2017 Information Cash $ 26,000 Marketable securities $ 58,000 Inventory $ 910,000 Fixed assets $4,975,000 Accumulated depreciation $1,364,000 Intangible assets $ 431,000 Notes payable $ 210,000 Total current liabilities $ 889,000 Common stock $ 330,000 Retained earnings $ 701,000 Total liabilities and owners' equity $5,832,000 Source: Data from REACH Manufacturing, Inc. a. Reconstruct the balance sheet for 2016 and 2017 using a spreadsheet, and find the change in each account and each category balance (current assets, long-term assets, total assets, current liabilities, total liabilities, total owners' equity, and total liabilities and owners' equity) from 2016 to 2017. The balance sheet has the same accounts in both years. Verify that the change in the total assets equals the change in the total liabilities and owners' equity. b. Find the cash from assets for 2016 if the OCF for that year is $389,000. Note: Treat intangible assets as a capital spending item. 2. Balance sheet. Reach Manufacturing has lost its computer systems and must reconstruct the last two years of its balance sheet. The company has been able to get the following information out of its crashed computer: 2016 Information Cash $ 23,000 Accounts receivable $ 518,000 Inventory $ 639,000 Total current assets $1,242,000 Fixed assets $ 4,387,000 Intangible assets $ 465,000 Total assets $5,085,000 Accounts payable $ 419,000 Notes payable $ 390,000 Long-term debt $3,540,000 Common stock $ 330,000 2017 Information Cash $ 26,000 Marketable securities $ 58,000 Inventory $ 910,000 Fixed assets $4,975,000 Accumulated depreciation $1,364,000 Intangible assets $ 431,000 Notes payable $ 210,000 Total current liabilities $ 889,000 Common stock $ 330,000 Retained earnings $ 701,000 Total liabilities and owners' equity $5,832,000 Source: Data from REACH Manufacturing, Inc. a. Reconstruct the balance sheet for 2016 and 2017 using a spreadsheet, and find the change in each account and each category balance (current assets, long-term assets, total assets, current liabilities, total liabilities, total owners' equity, and total liabilities and owners' equity) from 2016 to 2017. The balance sheet has the same accounts in both years. Verify that the change in the total assets equals the change in the total liabilities and owners' equity. b. Find the cash from assets for 2016 if the OCF for that year is $389,000. Note: Treat intangible assets as a capital spending item

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts