Question: 2. Barry Husowitz bought a house for $293,000. He put 20% down and obtained an interest amortized loan for the balance at 5(3/8)% annually interest

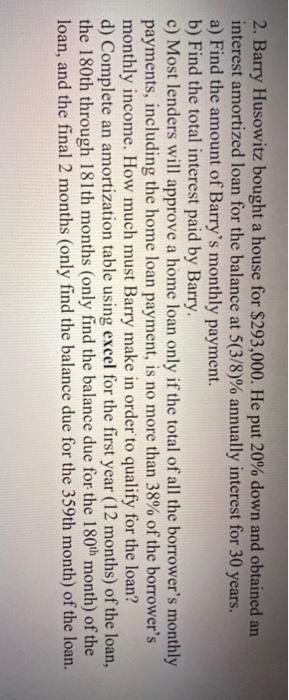

2. Barry Husowitz bought a house for $293,000. He put 20% down and obtained an interest amortized loan for the balance at 5(3/8)% annually interest for 30 years. a) Find the amount of Barry's monthly payment. b) Find the total interest paid by Barry. c) Most lenders will approve a home loan only if the total of all the borrower's monthly payments, including the home loan payment, is no more than 38% of the borrower's monthly income. How much must Barry make in order to qualify for the loan? d) Complete an amortization table using excel for the first year (12 months) of the loan, the 180th through 181th months (only find the balance due for the 180th month) of the loan, and the final 2 months (only find the balance due for the 359th month) of the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts