Question: 2. Base-case Analysis: Under the base-case/expected demand, revenues and costs, estimate the total late the NPV of Thatcher Clinic. cash flows the clinic will generate

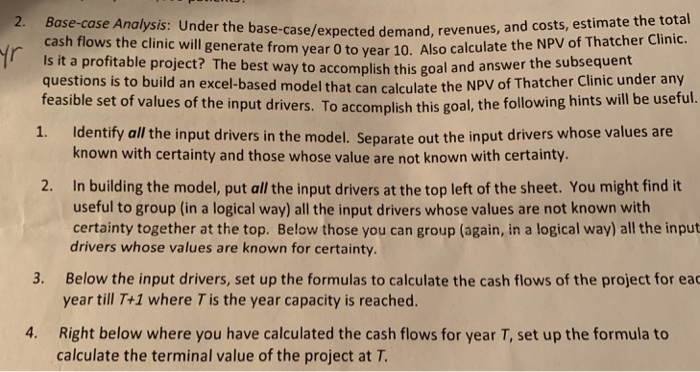

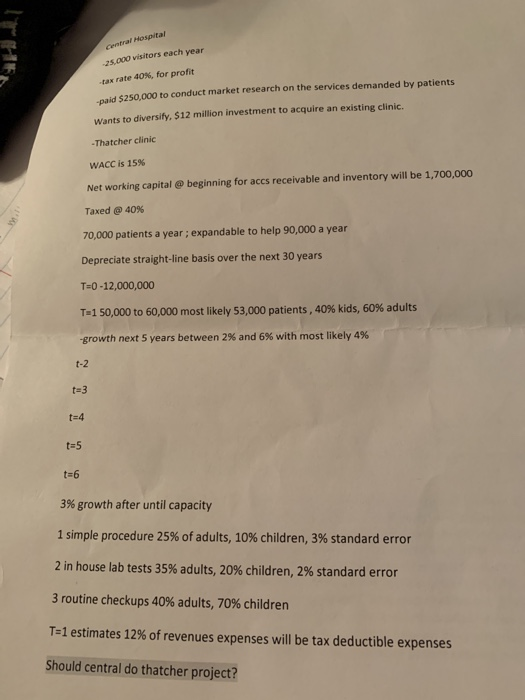

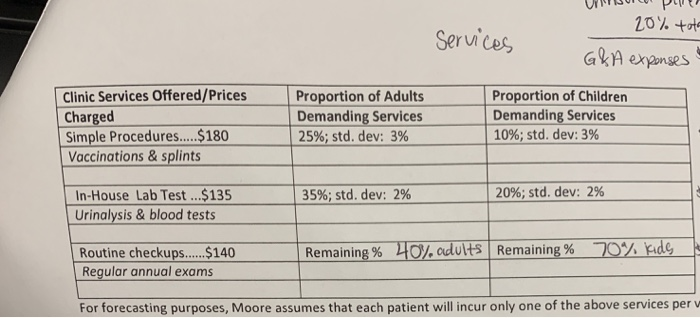

2. Base-case Analysis: Under the base-case/expected demand, revenues and costs, estimate the total late the NPV of Thatcher Clinic. cash flows the clinic will generate from year 0 to year 10. Also calcul Is it a profitable project? The best way to accomplish this goal and questions is to build an excel-based model that can calculate the feasible set of values of the input driv answer the subsequent NPV of Thatcher Clinic under any ers. To accomplish this goal, the following hints will be useful 1. Identify all the input drivers in the model. Separate out the input drivers whose values are known with certainty and those whose value are not known with certainty 2. In building the model, put all the input drivers at the top left of the sheet. You might find it useful to group (in a logical way) all the input drivers whose values are not known with certainty together at the top. Below those you can group (again, in a logical way) all the input drivers whose values are known for certainty. 3. Below the input drivers, set up the formulas to calculate the cash flows of the project for eac year till T+1 where T is the year capacity is reached. 4. Right below where you have calculated the cash flows for year T, set up the formula to calculate the terminal value of the project at al Hospital 25,000 visitors each year -tax rate 40%, for profit id $250,000 to conduct market research on the services demanded by patients Wants to diversify, $12 million investment to acquire an existing clinic. -Thatcher clinic WACC is 15% Net working capital @ beginning for accs receivable and inventory will be 1,700,000 Taxed @ 40% 70,000 patients a year; expandable to help 90,000 a year Depreciate straight-line basis over the next 30 years T-0-12,000,000 Tel 50,000 to 60,000 most likely 53,000 patients, 40% kids, 60% adults growth next 5 years between 2% and 6% with most likely 4% t-2 t-3 t-4 5 t-6 3% growth after until capacity 1 simple procedure 25% of adults, 10% children, 3% standard error 2 in house lab tests 35% adults, 20% children, 296 standard error 3 routine checkups 40% adults, 70% children T-1 estimates 12% of revenues expenses will be tax deductible expenses Should central do thatcher project? 20 % tot Servce panses Clinic Services Offered/Prices Proportion of AdultsProportion of Children Charged Simple Procedures. $180 Vaccinations&splints Demanding Services 10%; std. dev: 3% Demanding Services 2596; std. dev: 3% 20% std. dev: 2% 2% In-House Lab Test...$135 Urinalysis & blood tests 35%; std. dev: Remaining 9640. adults. Remaining % 70%kdg Regular annual exams For forecasting purposes, Moore assumes that each patient will incur only one of the above services per 2. Base-case Analysis: Under the base-case/expected demand, revenues and costs, estimate the total late the NPV of Thatcher Clinic. cash flows the clinic will generate from year 0 to year 10. Also calcul Is it a profitable project? The best way to accomplish this goal and questions is to build an excel-based model that can calculate the feasible set of values of the input driv answer the subsequent NPV of Thatcher Clinic under any ers. To accomplish this goal, the following hints will be useful 1. Identify all the input drivers in the model. Separate out the input drivers whose values are known with certainty and those whose value are not known with certainty 2. In building the model, put all the input drivers at the top left of the sheet. You might find it useful to group (in a logical way) all the input drivers whose values are not known with certainty together at the top. Below those you can group (again, in a logical way) all the input drivers whose values are known for certainty. 3. Below the input drivers, set up the formulas to calculate the cash flows of the project for eac year till T+1 where T is the year capacity is reached. 4. Right below where you have calculated the cash flows for year T, set up the formula to calculate the terminal value of the project at al Hospital 25,000 visitors each year -tax rate 40%, for profit id $250,000 to conduct market research on the services demanded by patients Wants to diversify, $12 million investment to acquire an existing clinic. -Thatcher clinic WACC is 15% Net working capital @ beginning for accs receivable and inventory will be 1,700,000 Taxed @ 40% 70,000 patients a year; expandable to help 90,000 a year Depreciate straight-line basis over the next 30 years T-0-12,000,000 Tel 50,000 to 60,000 most likely 53,000 patients, 40% kids, 60% adults growth next 5 years between 2% and 6% with most likely 4% t-2 t-3 t-4 5 t-6 3% growth after until capacity 1 simple procedure 25% of adults, 10% children, 3% standard error 2 in house lab tests 35% adults, 20% children, 296 standard error 3 routine checkups 40% adults, 70% children T-1 estimates 12% of revenues expenses will be tax deductible expenses Should central do thatcher project? 20 % tot Servce panses Clinic Services Offered/Prices Proportion of AdultsProportion of Children Charged Simple Procedures. $180 Vaccinations&splints Demanding Services 10%; std. dev: 3% Demanding Services 2596; std. dev: 3% 20% std. dev: 2% 2% In-House Lab Test...$135 Urinalysis & blood tests 35%; std. dev: Remaining 9640. adults. Remaining % 70%kdg Regular annual exams For forecasting purposes, Moore assumes that each patient will incur only one of the above services per

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts