Question: Question 5 (20 points) You want to create a virtual hot-rolled coil (HRC) steel mill with a capacity of 1,000 tons/month using the futures market

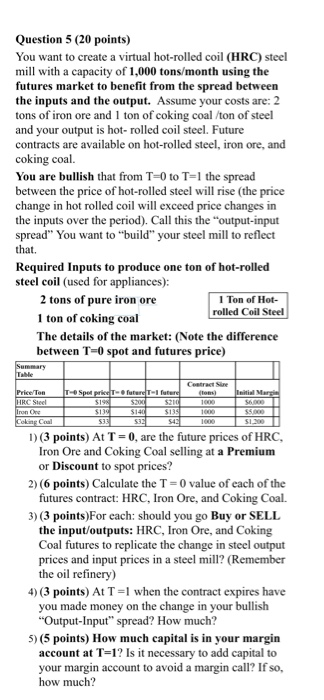

Question 5 (20 points) You want to create a virtual hot-rolled coil (HRC) steel mill with a capacity of 1,000 tons/month using the futures market to benefit from the spread between the inputs and the output. Assume your costs are: 2 tons of iron ore and 1 ton of coking coal /ton of steel and your output is hot-rolled coil steel. Future contracts are available on hot-rolled steel, iron ore, and coking coal. You are bullish that from T=0 to T1 the spread between the price of hot-rolled steel will rise (the price change in hot rolled coil will exceed price changes in the inputs over the period). Call this the "output-input spread" You want to "build your steel mill to reflect that. Required Inputs to produce one ton of hot-rolled steel coil (used for appliances): 2 tons of pure iron ore 1 Ton of Hot- rolled Coil Steel 1 ton of coking coal The details of the market: (Note the difference between T=0 spot and futures price) Price/Ton T-Spet pri f ter future Cons) i Margie IS19 S2S21010000 Coking Cal S33532 1) (3 points) At T = 0, are the future prices of HRC, Iron Ore and Coking Coal selling at a Premium or Discount to spot prices? 2) (6 points) Calculate the T = 0 value of each of the futures contract: HRC, Iron Ore, and Coking Coal. 3) (3 points)For each: should you go Buy or SELL the input/outputs: HRC, Iron Ore, and Coking Coal futures to replicate the change in steel output prices and input prices in a steel mill? (Remember the oil refinery) 4) (3 points) At T=1 when the contract expires have you made money on the change in your bullish "Output-Input" spread? How much? 5) (5 points) How much capital is in your margin account at T=1? Is it necessary to add capital to your margin account to avoid a margin call? If so, how much? Question 5 (20 points) You want to create a virtual hot-rolled coil (HRC) steel mill with a capacity of 1,000 tons/month using the futures market to benefit from the spread between the inputs and the output. Assume your costs are: 2 tons of iron ore and 1 ton of coking coal /ton of steel and your output is hot-rolled coil steel. Future contracts are available on hot-rolled steel, iron ore, and coking coal. You are bullish that from T=0 to T1 the spread between the price of hot-rolled steel will rise (the price change in hot rolled coil will exceed price changes in the inputs over the period). Call this the "output-input spread" You want to "build your steel mill to reflect that. Required Inputs to produce one ton of hot-rolled steel coil (used for appliances): 2 tons of pure iron ore 1 Ton of Hot- rolled Coil Steel 1 ton of coking coal The details of the market: (Note the difference between T=0 spot and futures price) Price/Ton T-Spet pri f ter future Cons) i Margie IS19 S2S21010000 Coking Cal S33532 1) (3 points) At T = 0, are the future prices of HRC, Iron Ore and Coking Coal selling at a Premium or Discount to spot prices? 2) (6 points) Calculate the T = 0 value of each of the futures contract: HRC, Iron Ore, and Coking Coal. 3) (3 points)For each: should you go Buy or SELL the input/outputs: HRC, Iron Ore, and Coking Coal futures to replicate the change in steel output prices and input prices in a steel mill? (Remember the oil refinery) 4) (3 points) At T=1 when the contract expires have you made money on the change in your bullish "Output-Input" spread? How much? 5) (5 points) How much capital is in your margin account at T=1? Is it necessary to add capital to your margin account to avoid a margin call? If so, how much

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts