Question: 2). Below are selected financial data on four different firms. Use the DuPont equation to identify why the ROEs of the four firms are different.

2).

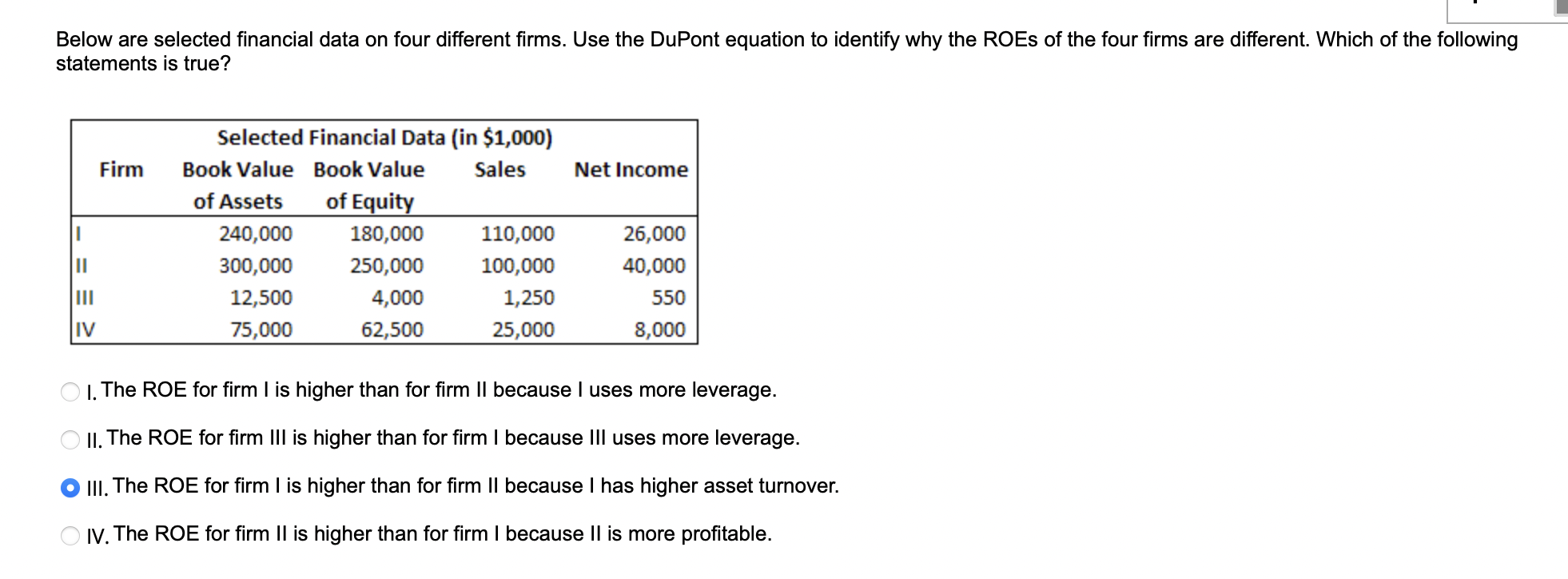

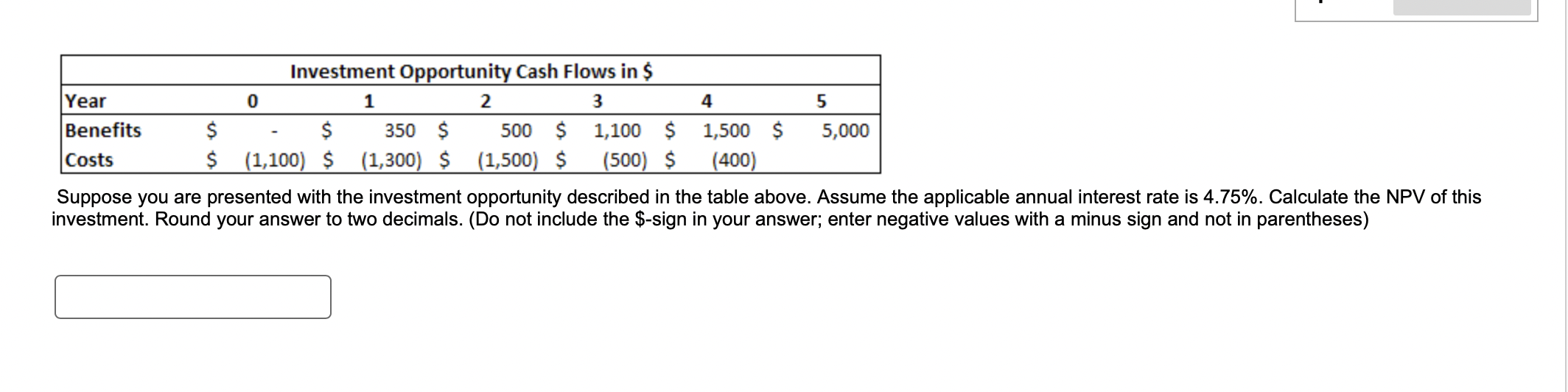

Below are selected financial data on four different firms. Use the DuPont equation to identify why the ROEs of the four firms are different. Which of the following statements is true? I. The ROE for firm I is higher than for firm II because I uses more leverage. II. The ROE for firm III is higher than for firm I because III uses more leverage. III. The ROE for firm I is higher than for firm II because I has higher asset turnover. IV. The ROE for firm II is higher than for firm I because II is more profitable. Suppose you are presented with the investment opportunity described in the table above. Assume the applicable annual interest rate is 4.75%. Calculate the NPV of this investment. Round your answer to two decimals. (Do not include the \$-sign in your answer; enter negative values with a minus sign and not in parentheses)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts