Question: Below are selected financial data on four different firms. Use the DuPont equation to identify why the ROEs of the four firms are different. Which

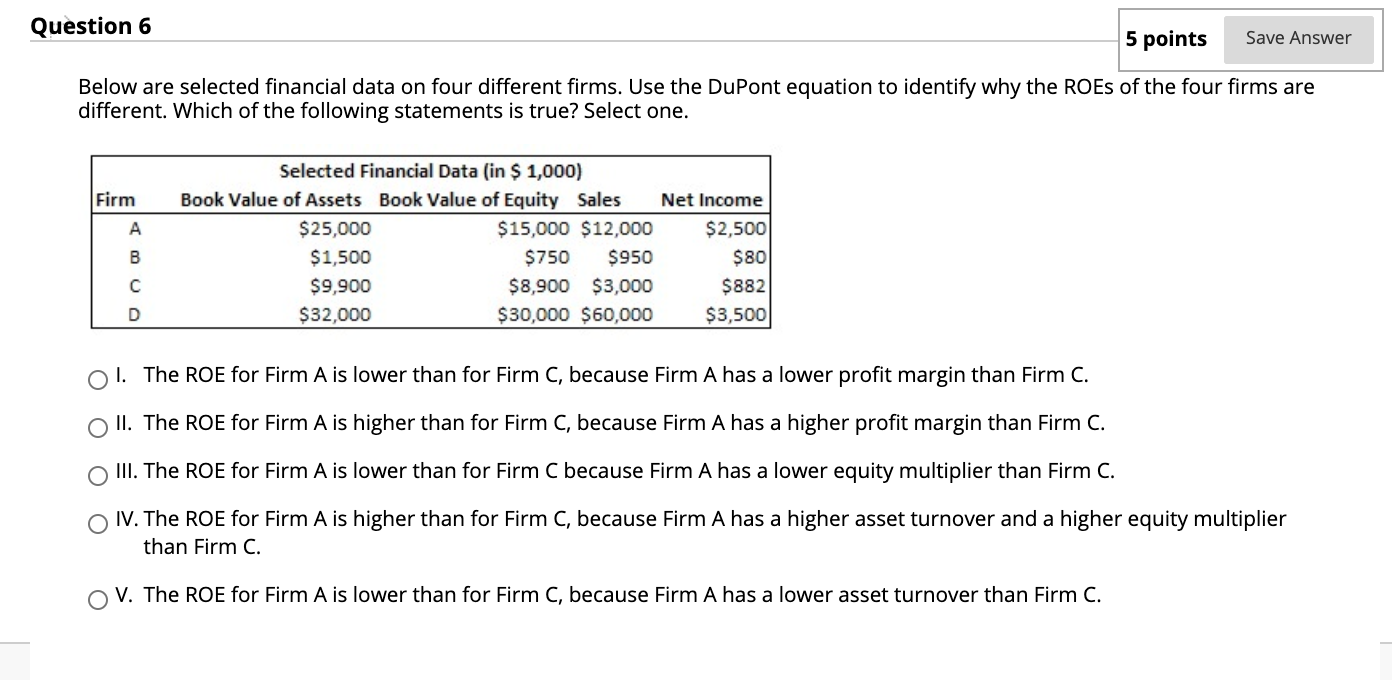

Below are selected financial data on four different firms. Use the DuPont equation to identify why the ROEs of the four firms are different. Which of the following statements is true? Select one.

I.The ROE for Firm A is lower than for Firm C, because Firm A has a lower profit margin than Firm C.

II.The ROE for Firm A is higher than for Firm C, because Firm A has a higher profit margin than Firm C.

III.The ROE for Firm A is lower than for Firm C because Firm A has a lower equity multiplier than Firm C.

IV.The ROE for Firm A is higher than for Firm C, because Firm A has a higher asset turnover and a higher equity multiplier than Firm C.

V.The ROE for Firm A is lower than for Firm C, because Firm A has a lower asset turnover than Firm C.

Question 6 5 points Save Answer Below are selected financial data on four different firms. Use the DuPont equation to identify why the ROEs of the four firms are different. Which of the following statements is true? Select one. Firm A Selected Financial Data (in $1,000) Book Value of Assets Book Value of Equity Sales Net Income $25,000 $15,000 $12,000 $2,500 $1,500 $750 $950 $80 $9,900 $8,900 $3,000 $882 $32,000 $30,000 $60,000 $3,500 B D 1. The ROE for Firm A is lower than for Firm C, because Firm A has a lower profit margin than Firm C. o II. The ROE for Firm A is higher than for Firm C, because Firm A has a higher profit margin than Firm C. III. The ROE for Firm A is lower than for Firm C because Firm A has a lower equity multiplier than Firm C. IV. The ROE for Firm A is higher than for Firm C, because Firm A has a higher asset turnover and a higher equity multiplier than Firm C. OV. The ROE for Firm A is lower than for Firm C, because Firm A has a lower asset turnover than Firm C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts