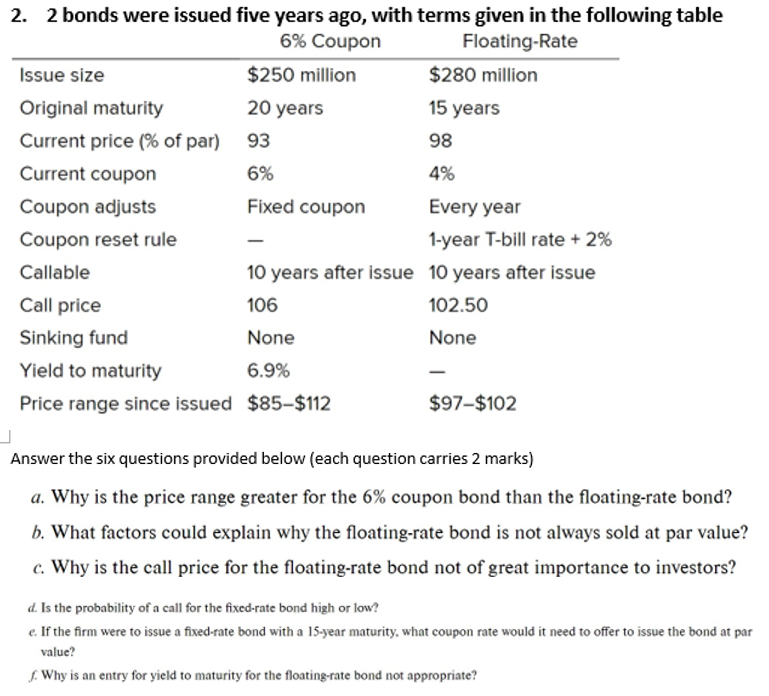

Question: 2 bonds were issued five years ago, with terms given in the following table Answer the six questions provided below ( each question carries 2

bonds were issued five years ago, with terms given in the following table

Answer the six questions provided below each question carries marks

a Why is the price range greater for the coupon bond than the floatingrate bond?

b What factors could explain why the floatingrate bond is not always sold at par value?

Why is the call price for the floatingrate bond not of great importance to investors?

d Is the probability of a call for the fixedrate bond high or low?

If the firm were to issue a fixedrate bond with a year maturity, what coupon rate would it need to offer to issue the bond at par

value?

Why is an entry for yield to maturity for the floatingrate bond not appropriate?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock