Question: 2. Calculate portfolio returns. [20 marks] To do so, take the following five steps: Track the performance (or, excess returns) of decile portfolios over one

![2. Calculate portfolio returns. [20 marks] To do so, take the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6702115d74dc7_7646702115ce1af3.jpg)

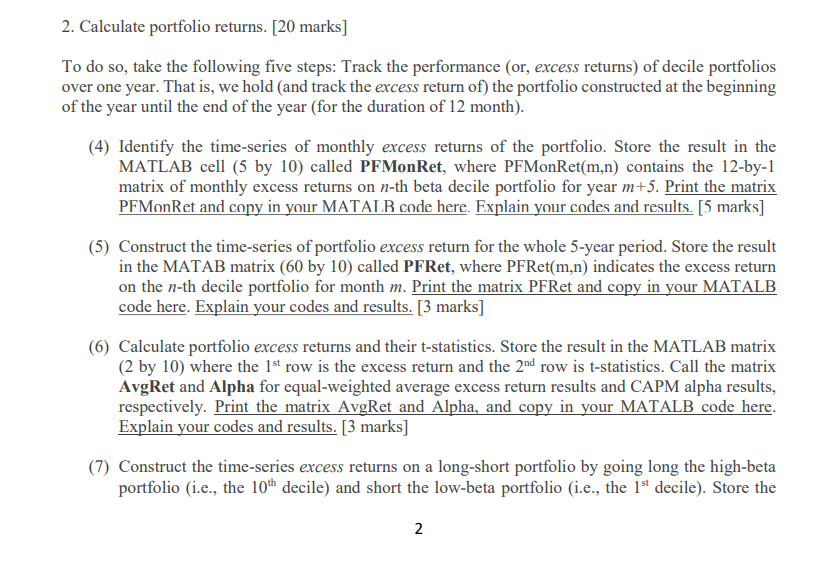

2. Calculate portfolio returns. [20 marks] To do so, take the following five steps: Track the performance (or, excess returns) of decile portfolios over one year. That is, we hold (and track the excess return of the portfolio constructed at the beginning of the year until the end of the year for the duration of 12 month). (4) Identify the time-series of monthly excess returns of the portfolio. Store the result in the MATLAB cell (5 by 10) called PF MonRet, where PF MonRet(m,n) contains the 12-by-1 matrix of monthly excess returns on n-th beta decile portfolio for year m+5. Print the matrix PF MonRet and copy in your MATALB code here. Explain your codes and results. [5 marks] (5) Construct the time-series of portfolio excess return for the whole 5-year period. Store the result in the MATAB matrix (60 by 10) called PF Ret, where PFRet(m,n) indicates the excess return on the n-th decile portfolio for month m. Print the matrix PFRet and copy in your MATALB code here. Explain your codes and results. [3 marks] (6) Calculate portfolio excess returns and their t-statistics. Store the result in the MATLAB matrix (2 by 10) where the 1st row is the excess return and the 2nd row is t-statistics. Call the matrix AvgRet and Alpha for equal-weighted average excess return results and CAPM alpha results, respectively. Print the matrix AvgRet and Alpha, and copy in your MATALB code here. Explain your codes and results. [3 marks] (7) Construct the time-series excess returns on a long-short portfolio by going long the high-beta portfolio (i.e., the 10th decile) and short the low-beta portfolio (i.c., the 1s* decile). Store the 2 IB93F0 Research Methods - Individual Assignment result in the MATLAB matrix (60 by 1) HML. Print the matrix PFMonRet and copy in your MATALB code here. Explain your codes and results. [5 marks] (8) Calculate equal weighted average excess returns, and alphas (and t-statistics) for the long-short portfolio. Store the result the MATALB matrix HML_AvgRet and HML_Alpha (both 2 by 1). Print the both matrices, and copy in your MATALB code here. Explain your codes and results. [4 marks) 2. Calculate portfolio returns. [20 marks] To do so, take the following five steps: Track the performance (or, excess returns) of decile portfolios over one year. That is, we hold (and track the excess return of) the portfolio constructed at the beginning of the year until the end of the year (for the duration of 12 month). (4) Identify the time-series of monthly excess returns of the portfolio. Store the result in the MATLAB cell (5 by 10) called PFMonRet, where PFMonRet(m,n) contains the 12-by-1 matrix of monthly excess returns on n-th beta decile portfolio for year m+5. Print the matrix PFMonRet and copy in your MATALB code here. Explain your codes and results. [5 marks] (5) Construct the time-series of portfolio excess return for the whole 5-year period. Store the result in the MATAB matrix (60 by 10) called PFRet, where PFRet(m,n) indicates the excess return on the n-th decile portfolio for month m. Print the matrix PFRet and copy in your MATALB code here. Explain your codes and results. [3 marks] (6) Calculate portfolio excess returns and their t-statistics. Store the result in the MATLAB matrix (2 by 10) where the 1st row is the excess return and the 2nd row is t-statistics. Call the matrix AvgRet and Alpha for equal-weighted average excess return results and CAPM alpha results, respectively. Print the matrix AvgRet and Alpha, and copy in your MATALB code here. Explain your codes and results. [3 marks] (7) Construct the time-series excess returns on a long-short portfolio by going long the high-beta portfolio (i.e., the 10th decile) and short the low-beta portfolio (i.e., the 1st decile). Store the 2 2. Calculate portfolio returns. [20 marks] To do so, take the following five steps: Track the performance (or, excess returns) of decile portfolios over one year. That is, we hold (and track the excess return of the portfolio constructed at the beginning of the year until the end of the year for the duration of 12 month). (4) Identify the time-series of monthly excess returns of the portfolio. Store the result in the MATLAB cell (5 by 10) called PF MonRet, where PF MonRet(m,n) contains the 12-by-1 matrix of monthly excess returns on n-th beta decile portfolio for year m+5. Print the matrix PF MonRet and copy in your MATALB code here. Explain your codes and results. [5 marks] (5) Construct the time-series of portfolio excess return for the whole 5-year period. Store the result in the MATAB matrix (60 by 10) called PF Ret, where PFRet(m,n) indicates the excess return on the n-th decile portfolio for month m. Print the matrix PFRet and copy in your MATALB code here. Explain your codes and results. [3 marks] (6) Calculate portfolio excess returns and their t-statistics. Store the result in the MATLAB matrix (2 by 10) where the 1st row is the excess return and the 2nd row is t-statistics. Call the matrix AvgRet and Alpha for equal-weighted average excess return results and CAPM alpha results, respectively. Print the matrix AvgRet and Alpha, and copy in your MATALB code here. Explain your codes and results. [3 marks] (7) Construct the time-series excess returns on a long-short portfolio by going long the high-beta portfolio (i.e., the 10th decile) and short the low-beta portfolio (i.c., the 1s* decile). Store the 2 IB93F0 Research Methods - Individual Assignment result in the MATLAB matrix (60 by 1) HML. Print the matrix PFMonRet and copy in your MATALB code here. Explain your codes and results. [5 marks] (8) Calculate equal weighted average excess returns, and alphas (and t-statistics) for the long-short portfolio. Store the result the MATALB matrix HML_AvgRet and HML_Alpha (both 2 by 1). Print the both matrices, and copy in your MATALB code here. Explain your codes and results. [4 marks) 2. Calculate portfolio returns. [20 marks] To do so, take the following five steps: Track the performance (or, excess returns) of decile portfolios over one year. That is, we hold (and track the excess return of) the portfolio constructed at the beginning of the year until the end of the year (for the duration of 12 month). (4) Identify the time-series of monthly excess returns of the portfolio. Store the result in the MATLAB cell (5 by 10) called PFMonRet, where PFMonRet(m,n) contains the 12-by-1 matrix of monthly excess returns on n-th beta decile portfolio for year m+5. Print the matrix PFMonRet and copy in your MATALB code here. Explain your codes and results. [5 marks] (5) Construct the time-series of portfolio excess return for the whole 5-year period. Store the result in the MATAB matrix (60 by 10) called PFRet, where PFRet(m,n) indicates the excess return on the n-th decile portfolio for month m. Print the matrix PFRet and copy in your MATALB code here. Explain your codes and results. [3 marks] (6) Calculate portfolio excess returns and their t-statistics. Store the result in the MATLAB matrix (2 by 10) where the 1st row is the excess return and the 2nd row is t-statistics. Call the matrix AvgRet and Alpha for equal-weighted average excess return results and CAPM alpha results, respectively. Print the matrix AvgRet and Alpha, and copy in your MATALB code here. Explain your codes and results. [3 marks] (7) Construct the time-series excess returns on a long-short portfolio by going long the high-beta portfolio (i.e., the 10th decile) and short the low-beta portfolio (i.e., the 1st decile). Store the 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts