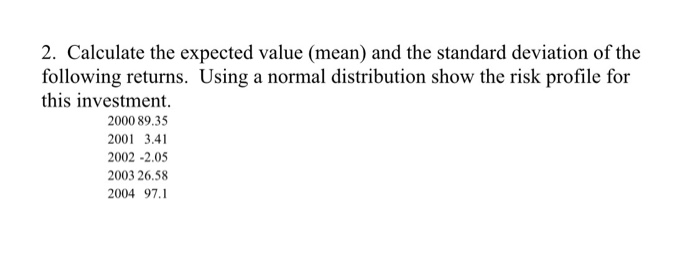

Question: 2. Calculate the expected value (mean) and the standard deviation of the following returns. Using a normal distribution show the risk profile for this investment

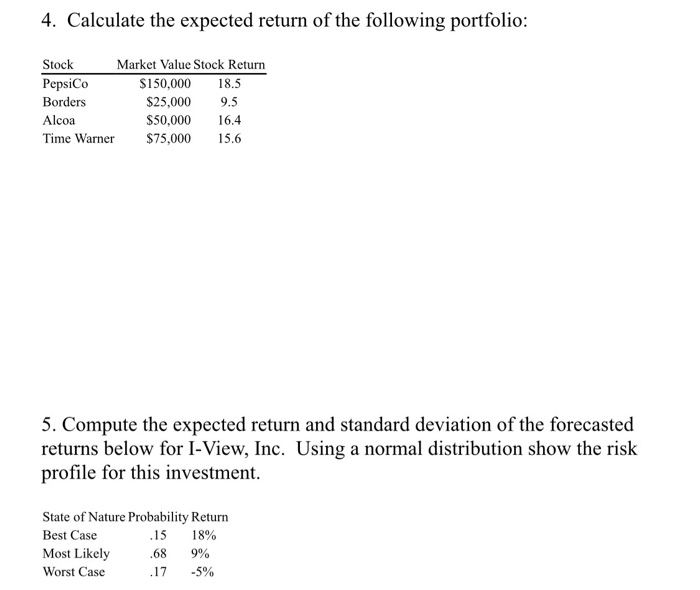

2. Calculate the expected value (mean) and the standard deviation of the following returns. Using a normal distribution show the risk profile for this investment 2000 89.35 2001 3.41 2002 -2.05 2003 26.58 2004 97.1 4. Calculate the expected return of the following portfolio: Stock PepsiCo Borders Alcoa Time Warner $75,000 5.6 Market Value Stock Return S150,000 18.5 $25,000 9.5 S50,000 16.4 5. Compute the expected return and standard deviation of the fo returns below for I-View, Inc. Using a normal distribution show the risk profile for this investment. State of Nature Probability Return Best Case Most Likely 68 Worst Case .17.5% .15 18%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts