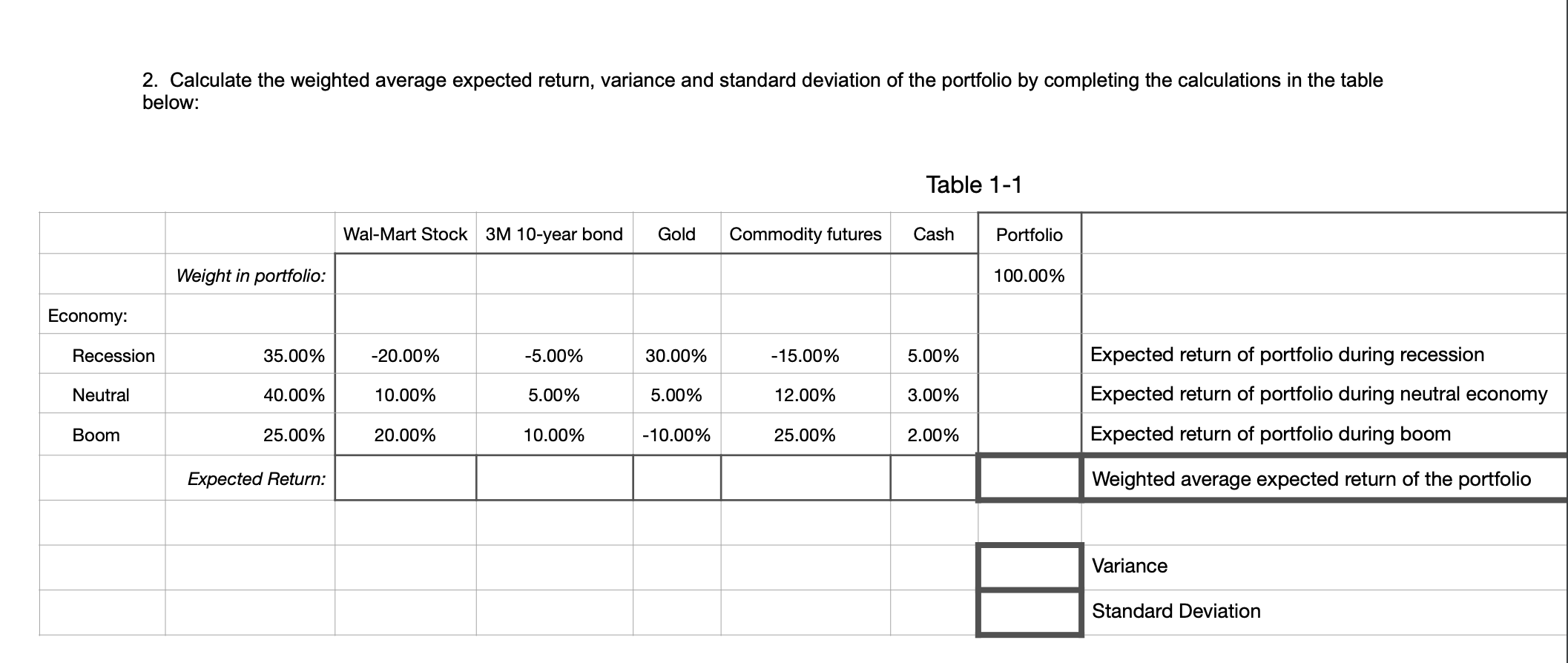

Question: 2. Calculate the weighted average expected return, variance and standard deviation of the portfolio by completing the calculations in the table below: Table 1-1 Wal-Mart

2. Calculate the weighted average expected return, variance and standard deviation of the portfolio by completing the calculations in the table below: Table 1-1 Wal-Mart Stock 3M 10-year bond Gold Commodity futures Cash Portfolio Weight in portfolio: 100.00% Economy: Recession 35.00% -20.00% -5.00% 30.00% -15.00% 5.00% Expected return of portfolio during recession Neutral 40.00% 10.00% 5.00% 5.00% 12.00% 3.00% Expected return of portfolio during neutral economy Expected return of portfolio during boom Boom 25.00% 20.00% 10.00% -10.00% 25.00% 2.00% Expected Return: Weighted average expected return of the portfolio Variance Standard Deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts