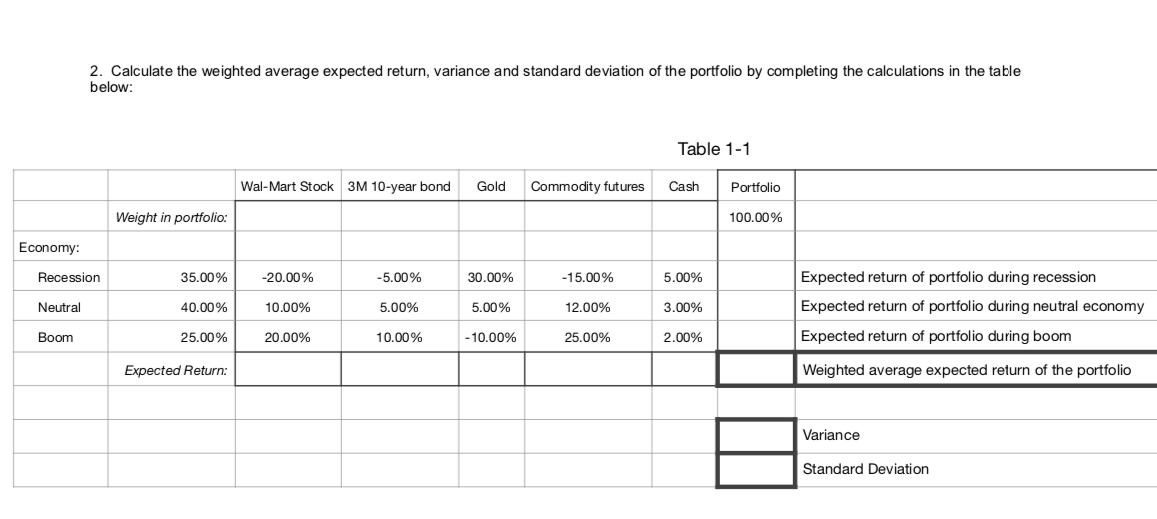

Question: 2. Calculate the weighted average expected return, variance and standard deviation of the portfolio by completing the calculations in the table below: Table 1-1 Wal-Mart

2. Calculate the weighted average expected return, variance and standard deviation of the portfolio by completing the calculations in the table below: Table 1-1 Wal-Mart Stock 3M 10-year bond Gold Commodity futures Cash Portfolio Weight in portfolio: 100.00% Economy: Recession 35.00% -20.00% -5.00% 30.00% -15.00% 5.00% Neutral 40.00% 10.00% 5.00% 5.00% 12.00% 3.00% Expected return of portfolio during recession Expected return of portfolio during neutral economy Expected return of portfolio during boom Boom 25.00% 20.00% 10.00% - 10.00% 25.00% 2.00% Expected Return: Weighted average expected return of the portfolio Variance Standard Deviation 2. Calculate the weighted average expected return, variance and standard deviation of the portfolio by completing the calculations in the table below: Table 1-1 Wal-Mart Stock 3M 10-year bond Gold Commodity futures Cash Portfolio Weight in portfolio: 100.00% Economy: Recession 35.00% -20.00% -5.00% 30.00% -15.00% 5.00% Neutral 40.00% 10.00% 5.00% 5.00% 12.00% 3.00% Expected return of portfolio during recession Expected return of portfolio during neutral economy Expected return of portfolio during boom Boom 25.00% 20.00% 10.00% - 10.00% 25.00% 2.00% Expected Return: Weighted average expected return of the portfolio Variance Standard Deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts