Question: 2. Can this Resource-Based View be an adequate framework to discuss how Starbucks can maintain their competitive advantages under this COVID-19 circumstance? Yes or No?

2. Can this Resource-Based View be an adequate framework to discuss how Starbucks can maintain their competitive advantages under this COVID-19 circumstance? Yes or No? Please explain why your answer is Yes or No. [Your answer should be one short paragraph.]

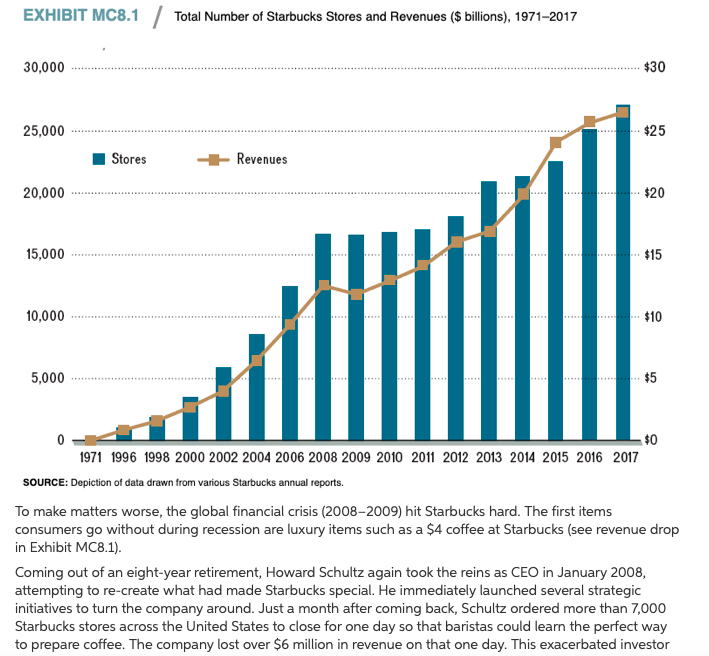

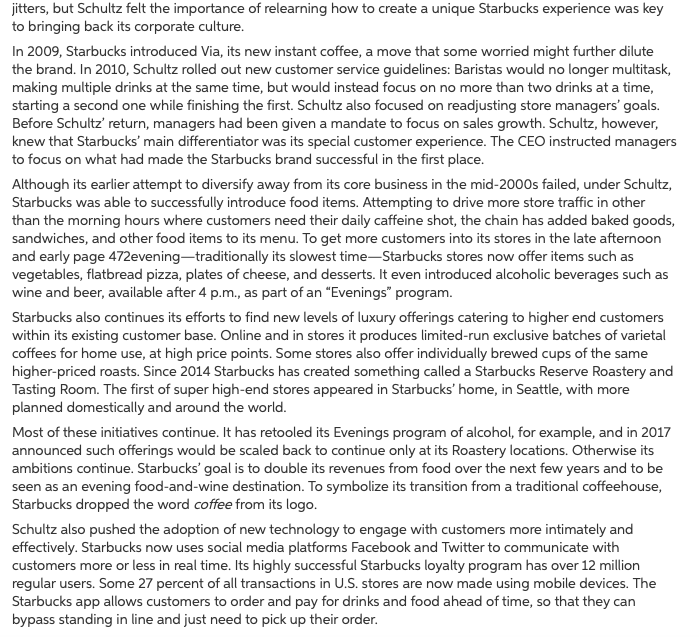

EXHIBIT MC8.1 / Total Number of Starbucks Stores and Revenues (5 billions), 1971-2017 30,000 $30 25,000 $25 Stores Revenues 20,000 $20 15,000 $15 10,000 $10 5,000 $5 0 $0 1971 1996 1998 2000 2002 2004 2006 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 SOURCE: Depiction of data drawn from various Starbucks annual reports. To make matters worse, the global financial crisis (2008-2009) hit Starbucks hard. The first items consumers go without during recession are luxury items such as a $4 coffee at Starbucks (see revenue drop in Exhibit MC8.1). Coming out of an eight-year retirement, Howard Schultz again took the reins as CEO in January 2008, attempting to re-create what had made Starbucks special. He immediately launched several strategic initiatives to turn the company around. Just a month after coming back, Schultz ordered more than 7,000 Starbucks stores across the United States to close for one day so that baristas could learn the perfect way to prepare coffee. The company lost over $6 million in revenue on that one day. This exacerbated investor jitters, but Schultz felt the importance of relearning how to create a unique Starbucks experience was key to bringing back its corporate culture. In 2009, Starbucks introduced Via, its new instant coffee, a move that some worried might further dilute the brand. In 2010, Schultz rolled out new customer service guidelines: Baristas would no longer multitask, making multiple drinks at the same time, but would instead focus on no more than two drinks at a time, starting a second one while finishing the first. Schultz also focused on readjusting store managers' goals. Before Schultz' return, managers had been given a mandate to focus on sales growth. Schultz, however, knew that Starbucks' main differentiator was its special customer experience. The CEO instructed managers to focus on what had made the Starbucks brand successful in the first place. Although its earlier attempt to diversify away from its core business in the mid-2000s failed, under Schultz, Starbucks was able to successfully introduce food items. Attempting to drive more store traffic in other than the morning hours where customers need their daily caffeine shot, the chain has added baked goods, sandwiches, and other food items to its menu. To get more customers into its stores in the late afternoon and early page 472evening-traditionally its slowest time-Starbucks stores now offer items such as vegetables, flatbread pizza, plates of cheese, and desserts. It even introduced alcoholic beverages such as wine and beer, available after 4 p.m., as part of an "Evenings" program. Starbucks also continues its efforts to find new levels of luxury offerings catering to higher end customers within its existing customer base. Online and in stores it produces limited-run exclusive batches of varietal coffees for home use, at high price points. Some stores also offer individually brewed cups of the same higher-priced roasts. Since 2014 Starbucks has created something called a Starbucks Reserve Roastery and Tasting Room. The first of super high-end stores appeared in Starbucks' home, in Seattle, with more planned domestically and around the world. Most of these initiatives continue. It has retooled its Evenings program of alcohol, for example, and in 2017 announced such offerings would be scaled back to continue only at its Roastery locations. Otherwise its ambitions continue. Starbucks' goal is to double its revenues from food over the next few years and to be seen as an evening food-and-wine destination. To symbolize its transition from a traditional coffeehouse, Starbucks dropped the word coffee from its logo. Schultz also pushed the adoption of new technology to engage with customers more intimately and effectively. Starbucks now uses social media platforms Facebook and Twitter to communicate with customers more or less in real time. Its highly successful Starbucks loyalty program has over 12 million regular users. Some 27 percent of all transactions in U.S. stores are now made using mobile devices. The Starbucks app allows customers to order and pay for drinks and food ahead of time, so that they can bypass standing in line and just need to pick up their order. Finally, as the U.S. market appears to be saturated with some 12,000 stores, Schultz believes that Starbucks has a great growth opportunity by opening more cafs overseas. Starbucks is planning to have more than 3,000 stores in China by 2019, up from 1,500 in 2015. Starbucks also plans to double its number of cafs elsewhere in Asia to more than 4,000 in the next few years. As the creator of Starbucks, however, Schultz enjoyed a degree of freedom that an ordinary CEO would not have had. Howard Schultz is to Starbucks much like Steve Jobs was to Apple. Schultz has the reputation and power of personality to implement a change that reduces operational effectiveness in favor of delighting customers. Schultz was able to orchestrate a successful turnaround, and with it Starbucks was able to gain and sustain a competitive advantage. Exhibit MC8.2 shows that Starbucks outperformed the wider stock market by a huge margin. EXHIBIT MC8.2 / Starbucks (SBUX) Normalized (% Change) Stock Appreciation from Initial Public Offering (IPO) on June 26, 1992, to July 28, 2017. Comparison is Dow Jones Industrials. Starbucks Price% Change Jul 28 '17 15.97K% 18.75% -Dow Jones Industrials Level % Change Jul 28 '17 565.10% April 2, 2017 16.756% Howard Schultz 2nd retirement 15.97% 13.75K% 11.25K% 8.75K% April 6, 2000 Howard Schultz, 1st retirement January 8, 2008 Howard Schultz returns 6.25% June 26, 1992 SBUX IPO 3.75K% 1.25K% 2565.10% -1.25% 1995 2000 2010 2015 2017 SOURCE: Depiction of publicly available data page 473 In April 2017, Howard Schultz stepped down as Starbucks CEO, in a second attempt to retire. Starbucks' new CEO is Kevin Johnson, who served as chief operating officer and second in command under Schultz. Schultz came out of retirement in 2008 when Starbucks was failing, and initiated a successful turnaround. His struggles are captured well in the title of his New York Times bestseller: Onward: How Starbucks Fought for its Life without Losing Its Soul. After his return, Starbucks' market valuation appreciated some five-fold! Although Schultz clearly engineered a hugely successful turnaround of his beloved Starbucks, the question is whether the new CEO can sustain Starbucks' competitive advantageStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts