Question: (2) Carl Bowen worked with First Union Limited for twenty (20) years prior to his redundancy in May 2020. His salary for the last

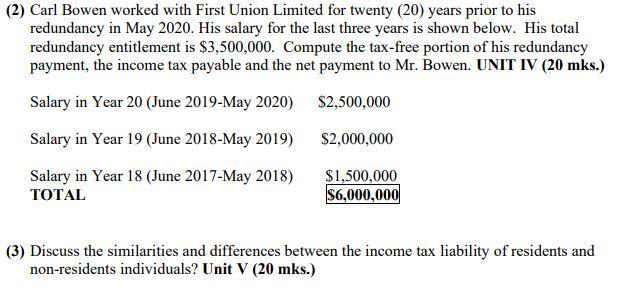

(2) Carl Bowen worked with First Union Limited for twenty (20) years prior to his redundancy in May 2020. His salary for the last three years is shown below. His total redundancy entitlement is $3,500,000. Compute the tax-free portion of his redundancy payment, the income tax payable and the net payment to Mr. Bowen. UNIT IV (20 mks.) Salary in Year 20 (June 2019-May 2020) $2,500,000 Salary in Year 19 (June 2018-May 2019) $2,000,000 Salary in Year 18 (June 2017-May 2018) TAL $1,500,000 $6,000,000 (3) Discuss the similarities and differences between the income tax liability of residents and non-residents individuals? Unit V (20 mks.)

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Fr emlyees wh hve been ntinuusly emlyed fr nt less thn three yers nd whse verge emluments fr the ... View full answer

Get step-by-step solutions from verified subject matter experts