Question: 2. Cash flow matching vs. Immunization A pension manager must fund a series of payments. The payments and the prices of zero coupon bonds associated

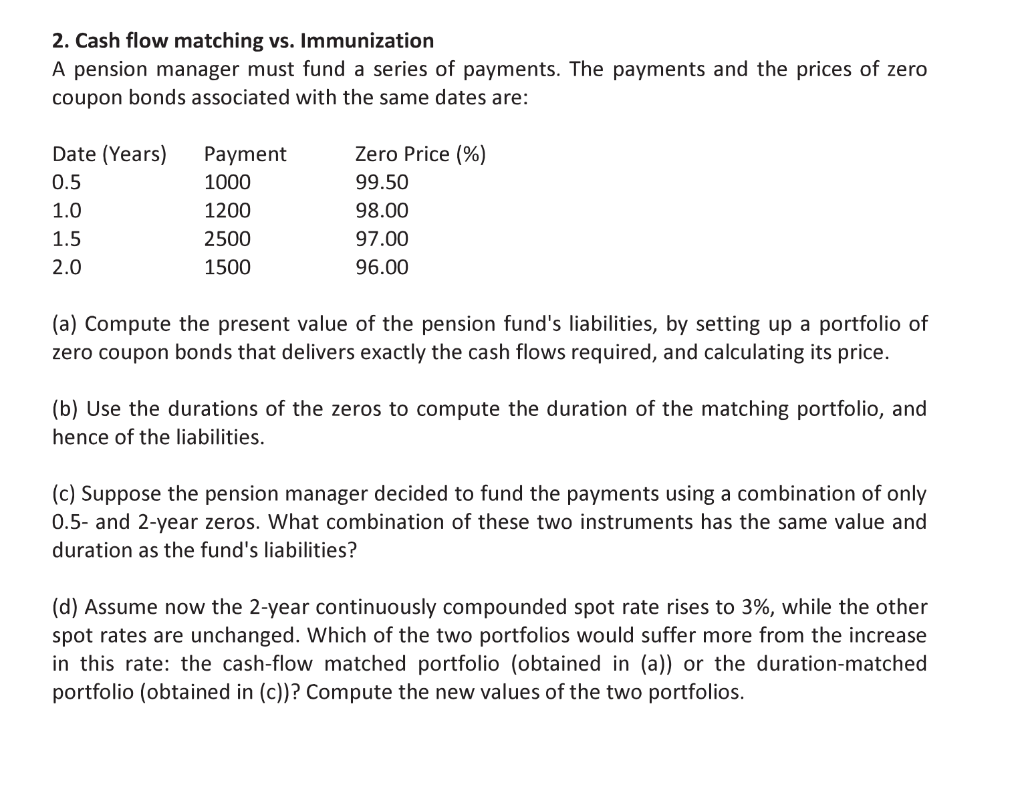

2. Cash flow matching vs. Immunization A pension manager must fund a series of payments. The payments and the prices of zero coupon bonds associated with the same dates are: Date (Years) 0.5 1.0 1.5 2.0 Payment 1000 1200 2500 1500 Zero Price (%) 99.50 98.00 97.00 96.00 (a) Compute the present value of the pension fund's liabilities, by setting up a portfolio of zero coupon bonds that delivers exactly the cash flows required, and calculating its price. (b) Use the durations of the zeros to compute the duration of the matching portfolio, and hence of the liabilities. (c) Suppose the pension manager decided to fund the payments using a combination of only 0.5- and 2-year zeros. What combination of these two instruments has the same value and duration as the fund's liabilities? (d) Assume now the 2-year continuously compounded spot rate rises to 3%, while the other spot rates are unchanged. Which of the two portfolios would suffer more from the increase in this rate: the cash-flow matched portfolio (obtained in (a)) or the duration-matched portfolio (obtained in (c))? Compute the new values of the two portfolios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts