Question: 2. CML and SML. In adjacent graphs with the same scale on the y-axis, plot the Capital Market Line in one graph and the Security

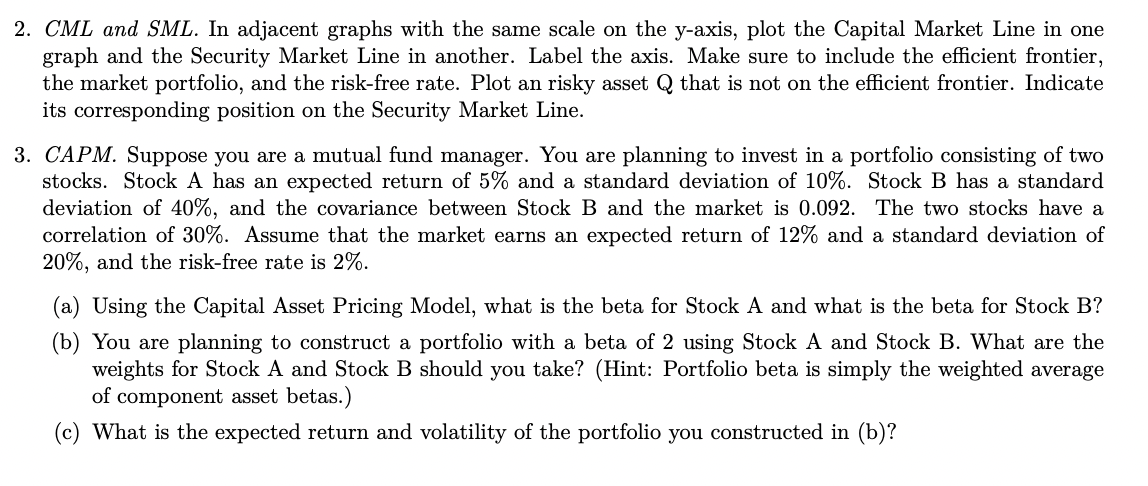

2. CML and SML. In adjacent graphs with the same scale on the y-axis, plot the Capital Market Line in one graph and the Security Market Line in another. Label the axis. Make sure to include the efficient frontier, the market portfolio, and the risk-free rate. Plot an risky asset Q that is not on the efficient frontier. Indicate its corresponding position on the Security Market Line. 3. CAPM. Suppose you are a mutual fund manager. You are planning to invest in a portfolio consisting of two stocks. Stock A has an expected return of 5% and a standard deviation of 10%. Stock B has a standard deviation of 40%, and the covariance between Stock B and the market is 0.092. The two stocks have a correlation of 30%. Assume that the market earns an expected return of 12% and a standard deviation of 20%, and the risk-free rate is 2%. (a) Using the Capital Asset Pricing Model, what is the beta for Stock A and what is the beta for Stock B? (b) You are planning to construct a portfolio with a beta of 2 using Stock A and Stock B. What are the weights for Stock A and Stock B should you take? (Hint: Portfolio beta is simply the weighted average of component asset betas.) (c) What is the expected return and volatility of the portfolio you constructed in (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts