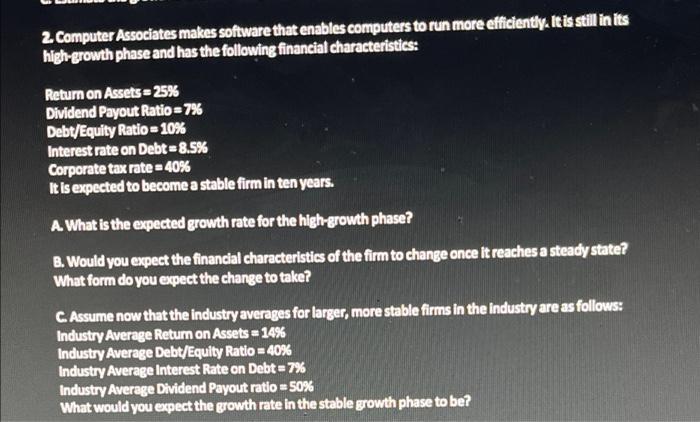

Question: 2. Computer Associates makes software that enables computers to run more efficiently. It is still in its high-growth phase and has the following financial characteristics:

2. Computer Associates makes software that enables computers to run more efficiently. It is still in its high-growth phase and has the following financial characteristics: Return on Assets = 25% Dividend Payout Ratio=7% Debt/Equity Ratio - 10% Interest rate on Debt=8.5% Corporate tax rate=40% It is expected to become a stable firm in ten years. A. What is the expected growth rate for the high-growth phase? B. Would you expect the financial characteristics of the firm to change once it reaches a steady state? What form do you expect the change to take? C. Assume now that the industry averages for larger, more stable firms in the Industry are as follows: Industry Average Return on Assets = 14% Industry Average Debt/Equity Ratio = 40% Industry Average Interest Rate on Debt = 7% Industry Average Dividend Payout ratio = 50% What would you expect the growth rate in the stable growth phase to be? 2. Computer Associates makes software that enables computers to run more efficiently. It is still in its high-growth phase and has the following financial characteristics: Return on Assets = 25% Dividend Payout Ratio=7% Debt/Equity Ratio - 10% Interest rate on Debt=8.5% Corporate tax rate=40% It is expected to become a stable firm in ten years. A. What is the expected growth rate for the high-growth phase? B. Would you expect the financial characteristics of the firm to change once it reaches a steady state? What form do you expect the change to take? C. Assume now that the industry averages for larger, more stable firms in the Industry are as follows: Industry Average Return on Assets = 14% Industry Average Debt/Equity Ratio = 40% Industry Average Interest Rate on Debt = 7% Industry Average Dividend Payout ratio = 50% What would you expect the growth rate in the stable growth phase to be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts