Question: Computer Associates makes software that enoles computers to run more efficiently. It is still in its high-growth phase and has the following financial characteristice Return

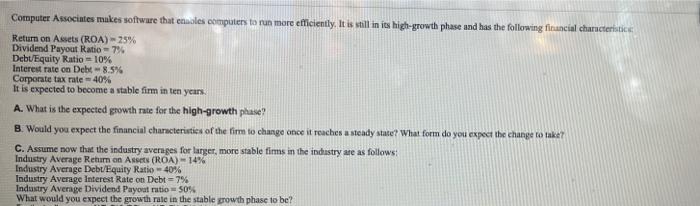

Computer Associates makes software that enoles computers to run more efficiently. It is still in its high-growth phase and has the following financial characteristice Return on Assets (ROA) -25% Dividend Payout Ratio -7% DebuEquity Ratio = 10% Interest rate on Debt-8.5% Corporate tax rate -40% It is expected to become a stable firm in ten years A. What is the expected growth rate for the high-growth phase? B. Would you expect the financial characteristics of the firm to change once it reaches a steady state? What form do you expect the change to take C. Assume now that the industry averages for larger, more stable firms in the industry are as follows: Industry Average Return on Asset (ROA) - 14% Industry Average Debt/Equity Ratio -40% Industry Average Interest Rate on Debt=7% Industry Average Dividend Payout ratio = 50% What would you expect the growth rate in the stable growth phase to be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts