Question: 2. Consider a CRR model with T = 2, So = $100, Si = $200 or Si = $50, and an associated European call option

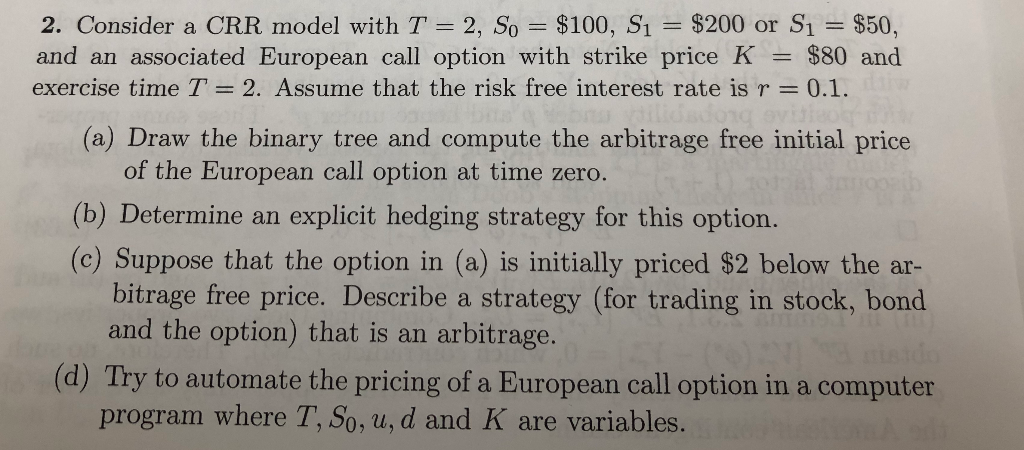

2. Consider a CRR model with T = 2, So = $100, Si = $200 or Si = $50, and an associated European call option with strike price K = $80 and exercise time T = 2. Assume that the risk free interest rate is r = 0.1. (a) Draw the binary tree and compute the arbitrage free initial price of the European call option at time zero. (b) Determine an explicit hedging strategy for this option. (c) Suppose that the option in (a) is initially priced $2 below the ar- bitrage free price. Describe a strategy (for trading in stock, bond and the option) that is an arbitrage. (d) Try to automate the pricing of a European call option in a computer program where T, So, u, d and K are variables. 2. Consider a CRR model with T = 2, So = $100, Si = $200 or Si = $50, and an associated European call option with strike price K = $80 and exercise time T = 2. Assume that the risk free interest rate is r = 0.1. (a) Draw the binary tree and compute the arbitrage free initial price of the European call option at time zero. (b) Determine an explicit hedging strategy for this option. (c) Suppose that the option in (a) is initially priced $2 below the ar- bitrage free price. Describe a strategy (for trading in stock, bond and the option) that is an arbitrage. (d) Try to automate the pricing of a European call option in a computer program where T, So, u, d and K are variables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts