Question: 6. Consider a CRR model with T = 2, So = $100, S1 = $200 or S = $50 (the same model as in Exercise

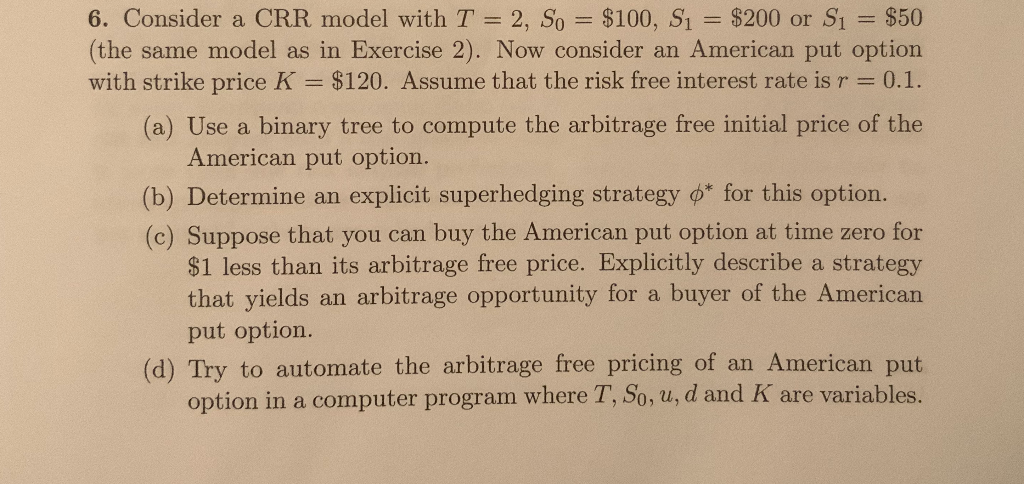

6. Consider a CRR model with T = 2, So = $100, S1 = $200 or S = $50 (the same model as in Exercise 2). Now consider an American put option with strike price K = $120. Assume that the risk free interest rate is r = 0.1. (a) Use a binary tree to compute the arbitrage free initial price of the American put option. (b) Determine an explicit superhedging strategy o* for this option. (c) Suppose that you can buy the American put option at time zero for $1 less than its arbitrage free price. Explicitly describe a strategy that yields an arbitrage opportunity for a buyer of the American put option (d) Try to automate the arbitrage free pricing of an American put option in a computer program where T, So, u, d and K are variables. 6. Consider a CRR model with T = 2, So = $100, S1 = $200 or S = $50 (the same model as in Exercise 2). Now consider an American put option with strike price K = $120. Assume that the risk free interest rate is r = 0.1. (a) Use a binary tree to compute the arbitrage free initial price of the American put option. (b) Determine an explicit superhedging strategy o* for this option. (c) Suppose that you can buy the American put option at time zero for $1 less than its arbitrage free price. Explicitly describe a strategy that yields an arbitrage opportunity for a buyer of the American put option (d) Try to automate the arbitrage free pricing of an American put option in a computer program where T, So, u, d and K are variables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts