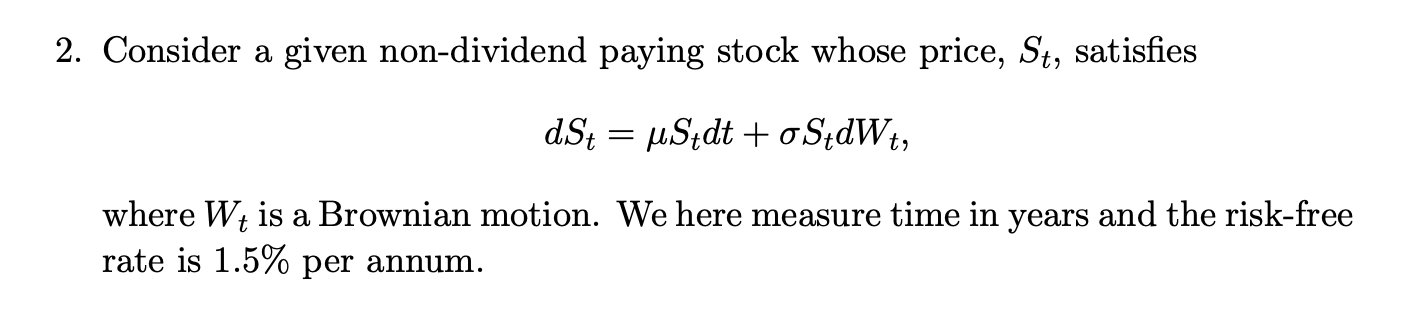

Question: 2. Consider a given non-dividend paying stock whose price, St, satisfies dSt = uStdt + oStdWt, where Wis a Brownian motion. We here measure time

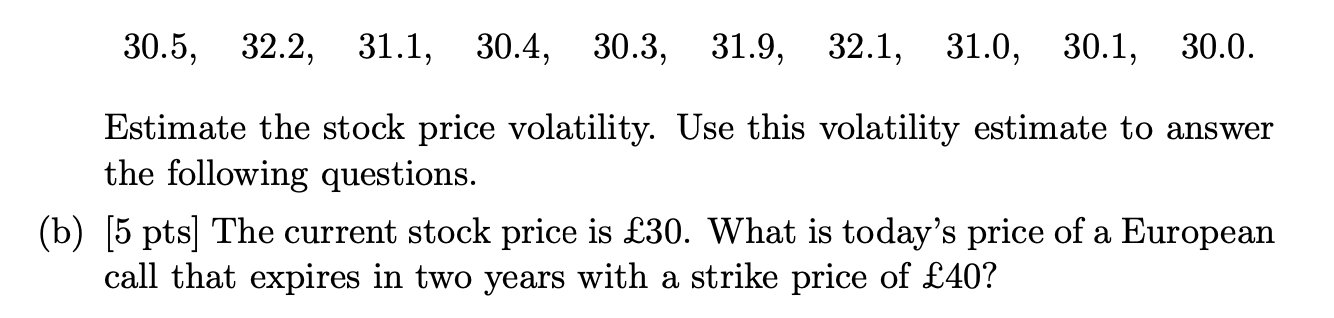

2. Consider a given non-dividend paying stock whose price, St, satisfies dSt = uStdt + oStdWt, where Wis a Brownian motion. We here measure time in years and the risk-free rate is 1.5% per annum. 30.5, 32.2, 31.1, 30.4, 30.3, 31.9, 32.1, 31.0, 30.1, 30.0. Estimate the stock price volatility. Use this volatility estimate to answer the following questions. (b) [5 pts] The current stock price is 30. What is today's price of a European call that expires in two years with a strike price of 40? 2. Consider a given non-dividend paying stock whose price, St, satisfies dSt = uStdt + oStdWt, where Wis a Brownian motion. We here measure time in years and the risk-free rate is 1.5% per annum. 30.5, 32.2, 31.1, 30.4, 30.3, 31.9, 32.1, 31.0, 30.1, 30.0. Estimate the stock price volatility. Use this volatility estimate to answer the following questions. (b) [5 pts] The current stock price is 30. What is today's price of a European call that expires in two years with a strike price of 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts