Question: 2. Consider a given non-dividend paying stock whose price, St, satisfies dSc = u Sidt + SidWt, where Wt is a Brownian motion. We here

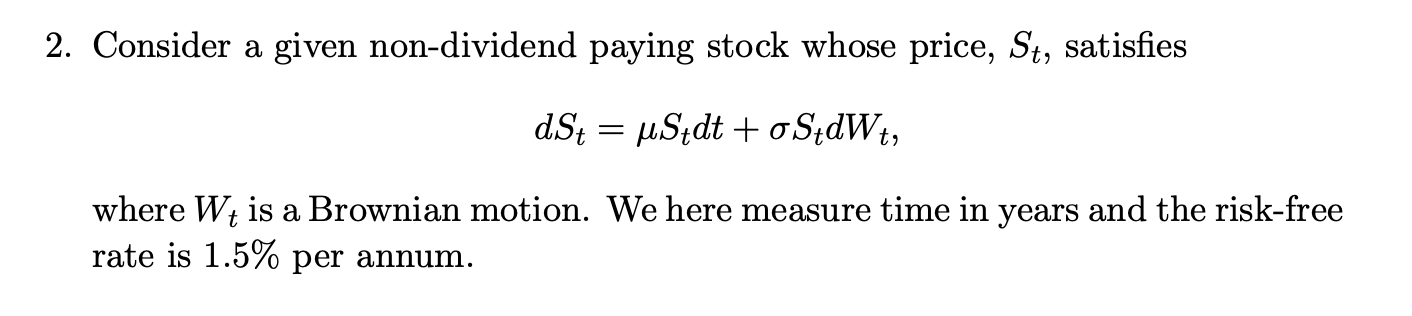

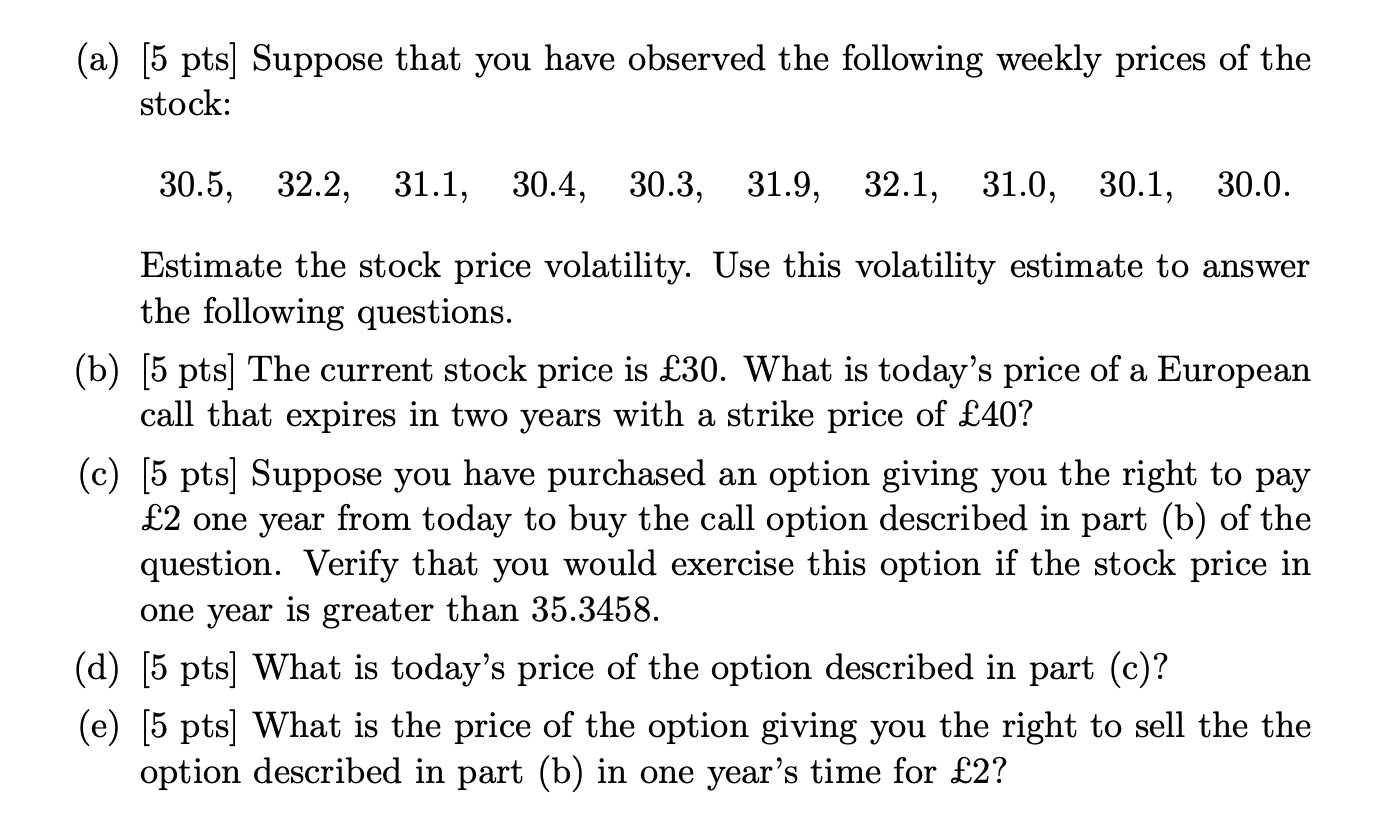

2. Consider a given non-dividend paying stock whose price, St, satisfies dSc = u Sidt + SidWt, where Wt is a Brownian motion. We here measure time in years and the risk-free rate is 1.5% per annum. (a) [5 pts] Suppose that you have observed the following weekly prices of the stock: 30.5, 32.2, 31.1, 30.4, 30.3, 31.9, 32.1, 31.0, 30.1, 30.0. Estimate the stock price volatility. Use this volatility estimate to answer the following questions. (b) [5 pts] The current stock price is 30. What is today's price of a European call that expires in two years with a strike price of 40? (c) [5 pts] Suppose you have purchased an option giving you the right to pay 2 one year from today to buy the call option described in part (b) of the question. Verify that you would exercise this option if the stock price in one year is greater than 35.3458. (d) [5 pts) What is today's price of the option described in part (c)? (e) [5 pts] What is the price of the option giving you the right to sell the the option described in part (b) in one year's time for 2? 2. Consider a given non-dividend paying stock whose price, St, satisfies dSc = u Sidt + SidWt, where Wt is a Brownian motion. We here measure time in years and the risk-free rate is 1.5% per annum. (a) [5 pts] Suppose that you have observed the following weekly prices of the stock: 30.5, 32.2, 31.1, 30.4, 30.3, 31.9, 32.1, 31.0, 30.1, 30.0. Estimate the stock price volatility. Use this volatility estimate to answer the following questions. (b) [5 pts] The current stock price is 30. What is today's price of a European call that expires in two years with a strike price of 40? (c) [5 pts] Suppose you have purchased an option giving you the right to pay 2 one year from today to buy the call option described in part (b) of the question. Verify that you would exercise this option if the stock price in one year is greater than 35.3458. (d) [5 pts) What is today's price of the option described in part (c)? (e) [5 pts] What is the price of the option giving you the right to sell the the option described in part (b) in one year's time for 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts