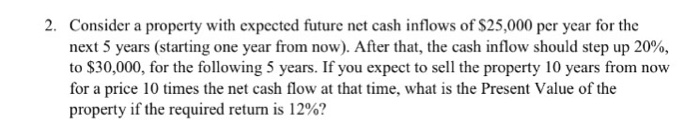

Question: 2. Consider a property with expected future net cash inflows of $25,000 per ycar for the next 5 years (starting one year from now). After

2. Consider a property with expected future net cash inflows of $25,000 per ycar for the next 5 years (starting one year from now). After that, the cash inflow should step up 20%, to $30,000, for the following 5 years. If you expect to sell the property 10 years from now for a price 10 times the net cash flow at that time, what is the Present Value of the property if the required return is 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts