Question: 2. Consider a two-period binomial model where a non-dividend paying stock's value evolves as follows: Suppose each period is one year. The risk-free rate is

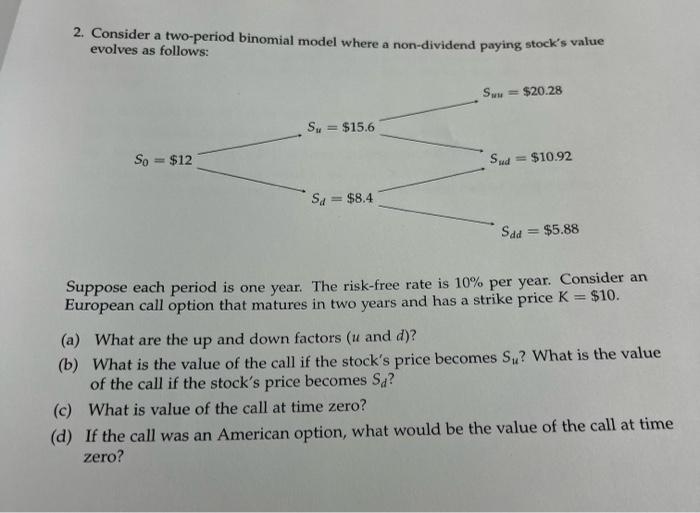

2. Consider a two-period binomial model where a non-dividend paying stock's value evolves as follows: Suppose each period is one year. The risk-free rate is 10% per year. Consider an European call option that matures in two years and has a strike price K=$10. (a) What are the up and down factors (u and d) ? (b) What is the value of the call if the stock's price becomes Su ? What is the value of the call if the stock's price becomes Sd ? (c) What is value of the call at time zero? (d) If the call was an American option, what would be the value of the call at time zero? 2. Consider a two-period binomial model where a non-dividend paying stock's value evolves as follows: Suppose each period is one year. The risk-free rate is 10% per year. Consider an European call option that matures in two years and has a strike price K=$10. (a) What are the up and down factors (u and d) ? (b) What is the value of the call if the stock's price becomes Su ? What is the value of the call if the stock's price becomes Sd ? (c) What is value of the call at time zero? (d) If the call was an American option, what would be the value of the call at time zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts