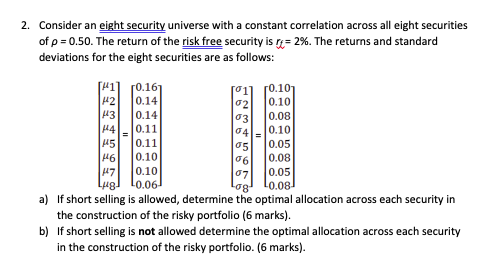

Question: 2. Consider an eight security universe with a constant correlation ass all eight securities of: 0.50. The return of the risk free security is re-296.

2. Consider an eight security universe with a constant correlation ass all eight securities of: 0.50. The return of the risk free security is re-296. The returns and standard deviations for the eight securities are as follows: #1 16 21 10.14 43 0.14 41-10.11 /51 0.11 61 10.10 71 10.10 2 0.10 031 10.08 40.10 5 0.05 a6 0.08 71 10.05 0.0 0.0 a) If short selling is allowed, determine the optimal aocation across each security in the construction of the risky portfolio (6 marks) b) If short selling is not allowed determine the optimal allocation across each security in the construction of the risky portfolio. (6 marks) 2. Consider an eight security universe with a constant correlation ass all eight securities of: 0.50. The return of the risk free security is re-296. The returns and standard deviations for the eight securities are as follows: #1 16 21 10.14 43 0.14 41-10.11 /51 0.11 61 10.10 71 10.10 2 0.10 031 10.08 40.10 5 0.05 a6 0.08 71 10.05 0.0 0.0 a) If short selling is allowed, determine the optimal aocation across each security in the construction of the risky portfolio (6 marks) b) If short selling is not allowed determine the optimal allocation across each security in the construction of the risky portfolio. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts