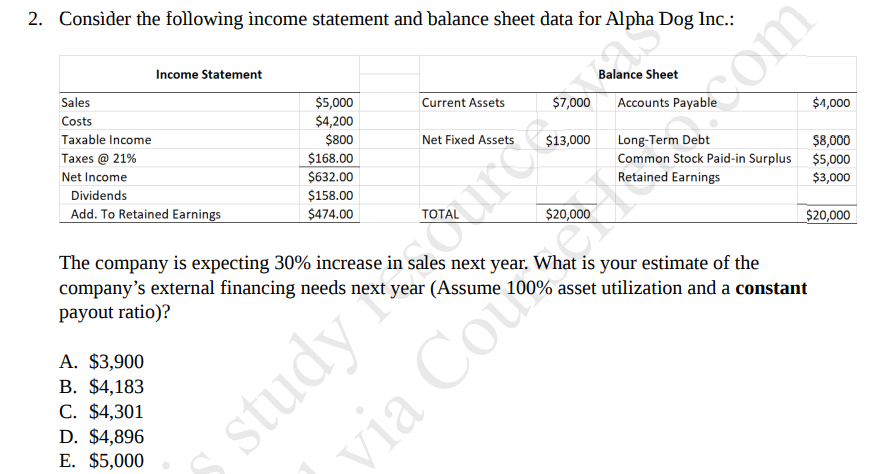

Question: 2. Consider the following income statement and balance sheet data for Alpha Dog Inc.: Income Statement Balance Sheet Accounts Payable Current Assets $7,000 $4,000 Solution

2. Consider the following income statement and balance sheet data for Alpha Dog Inc.: Income Statement Balance Sheet Accounts Payable Current Assets $7,000 $4,000 Solution om Net Fixed Assets $13,000 Sales Costs Taxable income Taxes @ 21% Net Income Dividends Add. To Retained Earnings $5,000 $4,200 $800 $168.00 $632.00 $158.00 $474.00 Long-Term Debt $8,000 Common Stock Paid-in Surplus $5,000 Retained Earnings $3,000 $20,000 $20,000 The company is expecting 30% increase in sales next year. What is your estimate of the company's external financing needs next year (Assume 100% asset utilization and a constant payout ratio)? A. $3,900 B. $4,183 C. $4,301 D. $4,896 E. $5,000 study via Colorare

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts