Question: 2. Currency Clauses: Risksharing Risk-sharing is a contractual arrangement in which the buyer and seller agree to share or split currency movement impacts on payments.

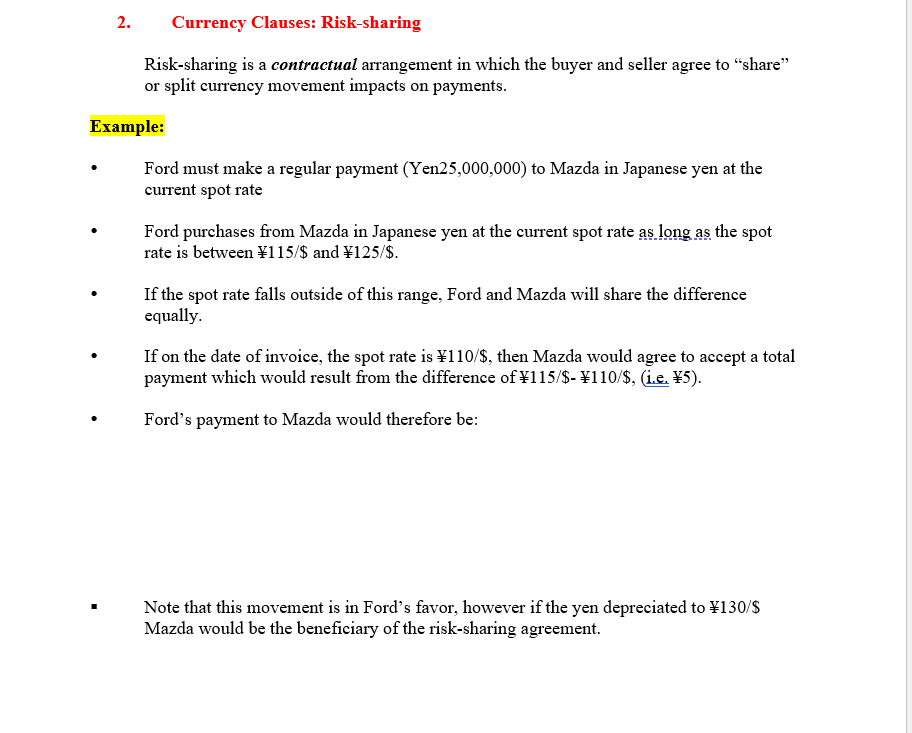

2. Currency Clauses: Risksharing Risk-sharing is a contractual arrangement in which the buyer and seller agree to \"share" or split currency movement impacts on payments. Example: ' Ford must make a regular payment (Y $125,000,000) to Mazda in Japanese yen at the current spot rate ' Ford purchases 'om Mazda in Japanese yen at the current spot rate asjgngag the spot rate is between 115f$ and 125f$. ' If the spot rate falls outside of this range, Ford and Mazda will share the difference equally. ' If on the date of invoice, the spot rate is 110f$, then Mazda would agree to accept a total payment which would result 'om the difference of 3?] 15f$- 110f$, @ 5). ' Ford's payment to Mazda would therefore be: ' Note that this movement is in Ford's favor, however if the yen depreciated to 130f$ NIazda would he the beneciary of the risk-sharing agreement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts