Question: Please fill in the blank 2. Currency Clauses: Risk-sharing Risk-sharing is a contractual arrangement in which the buyer and seller agree to share or split

Please fill in the blank

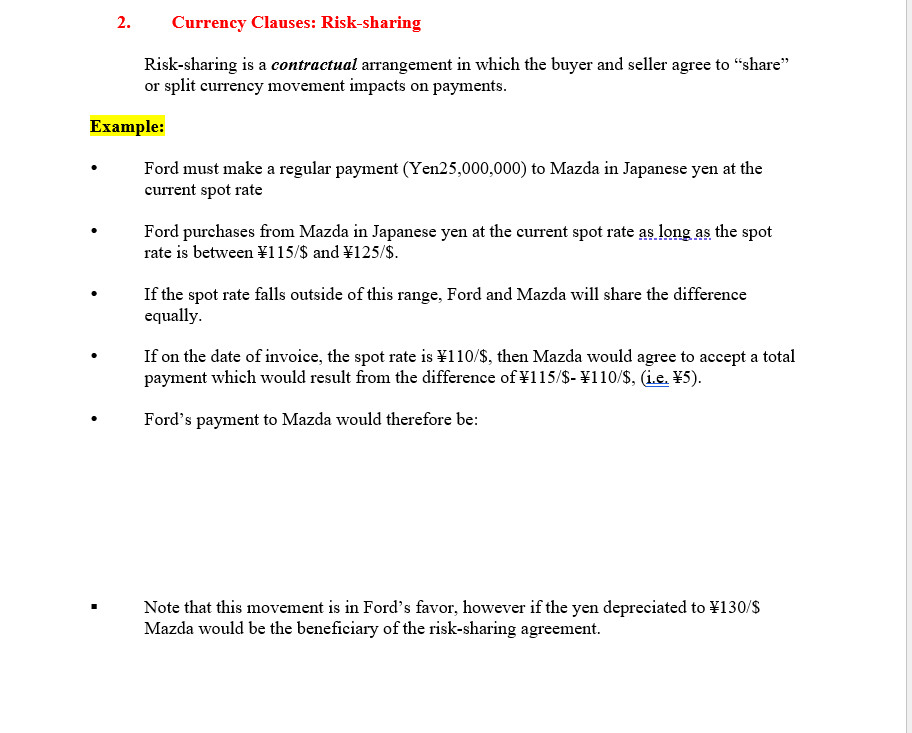

2. Currency Clauses: Risk-sharing Risk-sharing is a contractual arrangement in which the buyer and seller agree to share or split currency movement impacts on payments. Example: Ford must make a regular payment (Yen25,000,000) to Mazda in Japanese yen at the current spot rate Ford purchases froi Mazda in Japanese yen at the current spot rate as long as the spot rate is between 115/$ and \125/$. If the spot rate falls outside of this range, Ford and Mazda will share the difference equally. If on the date of invoice, the spot rate is 110/$, then Mazda would agree to accept a total payment which would result from the difference of115/$- 110/$, (i.e. 5). Ford's payment to Mazda would therefore be: Note that this movement is in Ford's favor, however if the yen depreciated to 130/$ Mazda would be the beneficiary of the risk-sharing agreement. 2. Currency Clauses: Risk-sharing Risk-sharing is a contractual arrangement in which the buyer and seller agree to share or split currency movement impacts on payments. Example: Ford must make a regular payment (Yen25,000,000) to Mazda in Japanese yen at the current spot rate Ford purchases froi Mazda in Japanese yen at the current spot rate as long as the spot rate is between 115/$ and \125/$. If the spot rate falls outside of this range, Ford and Mazda will share the difference equally. If on the date of invoice, the spot rate is 110/$, then Mazda would agree to accept a total payment which would result from the difference of115/$- 110/$, (i.e. 5). Ford's payment to Mazda would therefore be: Note that this movement is in Ford's favor, however if the yen depreciated to 130/$ Mazda would be the beneficiary of the risk-sharing agreement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts