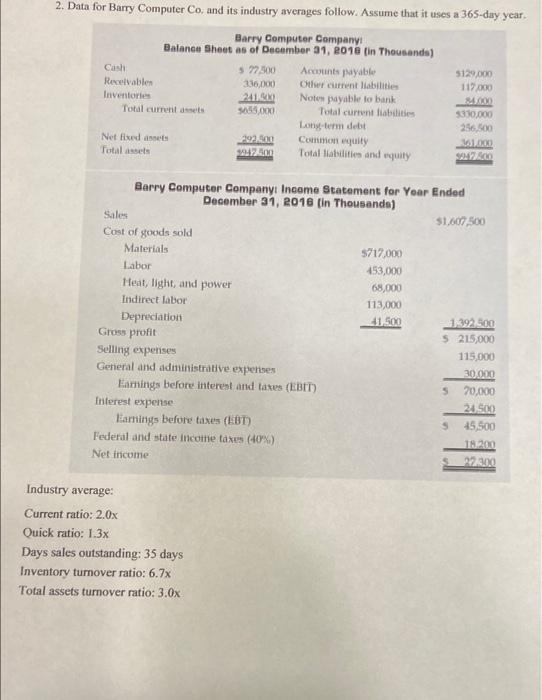

Question: 2. Data for Barry Computer Co, and its industry averages follow. Assume that it uses a 365-day year. Barry Computer Company Balance Sheet as of

2. Data for Barry Computer Co, and its industry averages follow. Assume that it uses a 365-day year. Barry Computer Company Balance Sheet as of December 31, 2016 in Thousands) Cash 5 72.500 Accounts payable 5129.000 Recevable 336.000 Other current liabilities 117.000 Inventories Notes payable to bank AD Total currentes 95.000 Total current liabilities 5330.000 Long-term debit 256,500 Net fixed at 92.000 Common equity 000 Total assets 00 Total Habilities and equity SAULIO Barry Computer Company Income Statement for Yoar Ended December 31, 2018 (in Thousanda) Sales $1,607,500 Cost of goods sold Materials 5717,000 Labor 453,000 Heat, light, and power 68,000 Indirect labor 113,000 Depreciation 41.500 1239200 Gross profit $ 215,000 Selling expenses 115,000 General and administrative experises 30.000 Earnings before interest and taxes (EBIT) 5 70,000 Interest expense 24 500 Eamnings before taxes (EBT) 5 45,500 Federal and state income taxes (40%) TA Net Income 20 Industry average: Current ratio: 2.0x Quick ratio: 1.3x Days sales outstanding: 35 days Inventory tumover ratio: 6.7x Total assets turnover ratio: 3.0x a. Calculate the following ratio for Berry: Current ratio Quick ratio Days sales outstanding Inventory turnover ratio Total assets turnover ratio b. Comment on the Berry's strength and weakness in terms of liquidity and asset management. List your reasons. 3. Kaye's Kitchenware has a market/book ratio equal to 1. Its stock price is $12 per share and it has 4.8 million shares outstanding. The firm's total capital is $110 million and it finances with only debt and common equity. What is its debt-to-capital ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts