Question: 2 Decomposing the VaR of a portfolio The attached python-code contains a function called draw_returns with one argument N. Calling the function returns N random

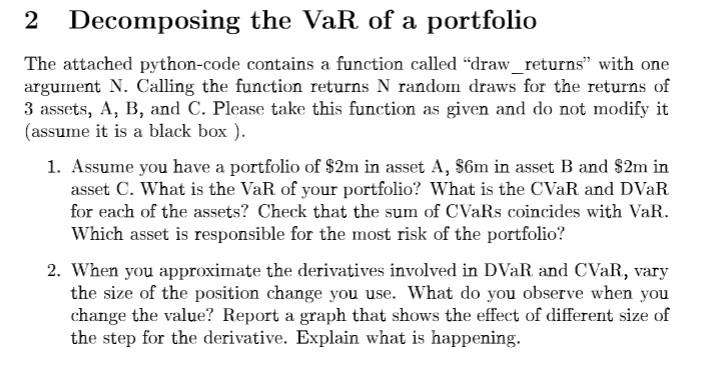

2 Decomposing the VaR of a portfolio The attached python-code contains a function called "draw_returns with one argument N. Calling the function returns N random draws for the returns of 3 assets, A, B, and C. Please take this function as given and do not modify it (assume it is a black box ). 1. Assume you have a portfolio of $2m in asset A, $6m in asset B and $2m in asset C. What is the VaR of your portfolio? What is the CVaR and DVR for each of the assets? Check that the sum of CVaRs coincides with VaR. Which asset is responsible for the most risk of the portfolio? 2. When you approximate the derivatives involved in DVaR and CVaR, vary the size of the position change you use. What do you observe when you change the value? Report a graph that shows the effect of different size of the step for the derivative. Explain what is happening. 3. You change your portfolio to $3m in asset A, S5m in asset B and $2m in asset C. What are the CVaR and DVaR for asset C? 2 Decomposing the VaR of a portfolio The attached python-code contains a function called "draw_returns with one argument N. Calling the function returns N random draws for the returns of 3 assets, A, B, and C. Please take this function as given and do not modify it (assume it is a black box ). 1. Assume you have a portfolio of $2m in asset A, $6m in asset B and $2m in asset C. What is the VaR of your portfolio? What is the CVaR and DVR for each of the assets? Check that the sum of CVaRs coincides with VaR. Which asset is responsible for the most risk of the portfolio? 2. When you approximate the derivatives involved in DVaR and CVaR, vary the size of the position change you use. What do you observe when you change the value? Report a graph that shows the effect of different size of the step for the derivative. Explain what is happening. 3. You change your portfolio to $3m in asset A, S5m in asset B and $2m in asset C. What are the CVaR and DVaR for asset C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts