Question: (2) Delmar Solutions after been operational for 5 years is currently aggressively seeking loan from BMO to avoid closing up. Management prepares their simple profit-and-loss

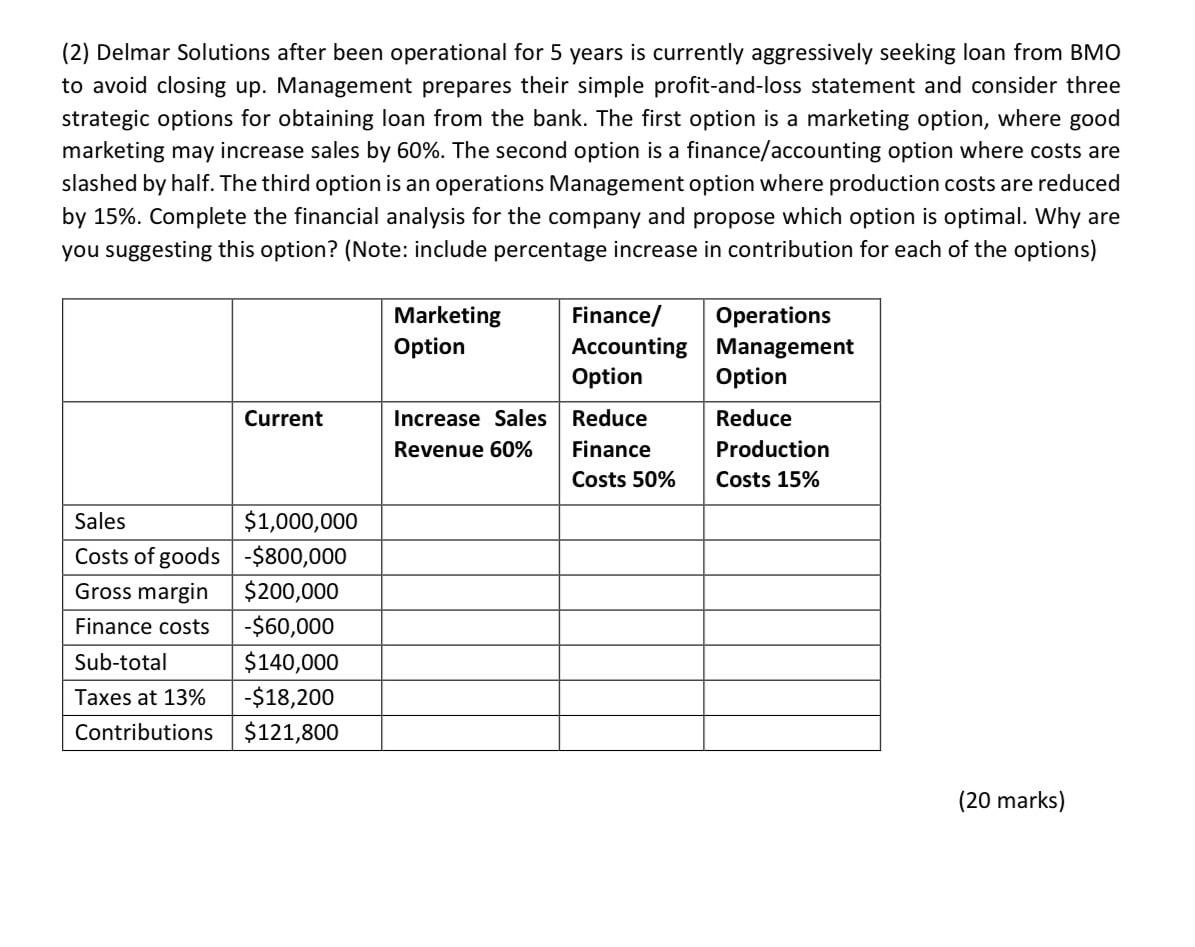

(2) Delmar Solutions after been operational for 5 years is currently aggressively seeking loan from BMO to avoid closing up. Management prepares their simple profit-and-loss statement and consider three strategic options for obtaining loan from the bank. The first option is a marketing option, where good marketing may increase sales by 60%. The second option is a finance/accounting option where costs are slashed by half. The third option is an operations Management option where production costs are reduced by 15%. Complete the financial analysis for the company and propose which option is optimal. Why are you suggesting this option? (Note: include percentage increase in contribution for each of the options) Marketing Option Finance/ Operations Accounting Management Option Option Current Increase Sales Reduce Revenue 60% Finance Costs 50% Reduce Production Costs 15% Sales $1,000,000 Costs of goods -$800,000 Gross margin $200,000 Finance costs -$60,000 Sub-total $140,000 Taxes at 13% -$18,200 Contributions $121,800 (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts