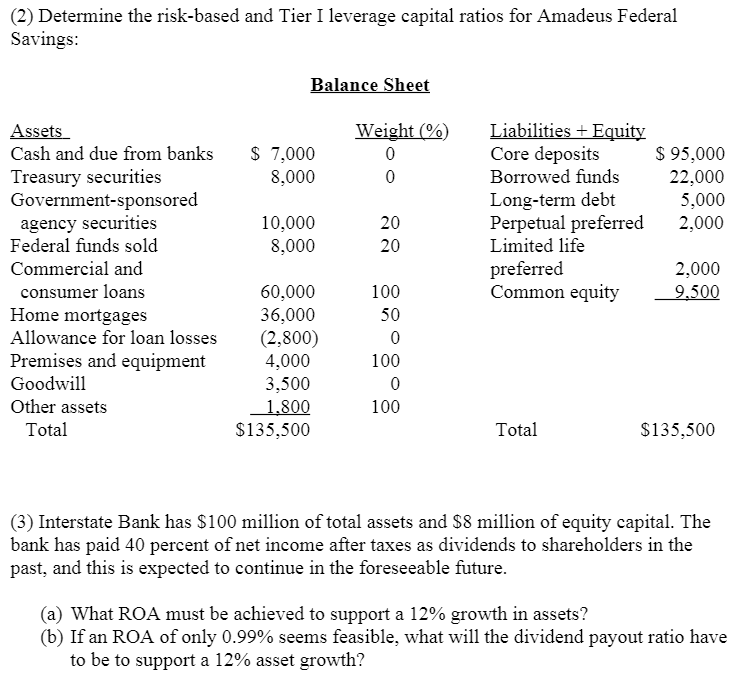

Question: (2) Determine the risk-based and Tier I leverage capital ratios for Amadeus Federal Savings: Balance Sheet $ 7,000 8,000 Weight (%) 0 0 Liabilities +

(2) Determine the risk-based and Tier I leverage capital ratios for Amadeus Federal Savings: Balance Sheet $ 7,000 8,000 Weight (%) 0 0 Liabilities + Equity Core deposits Borrowed funds Long-term debt Perpetual preferred Limited life preferred Common equity $ 95,000 22,000 5,000 2,000 10,000 8,000 Assets Cash and due from banks Treasury securities Government-sponsored agency securities Federal funds sold Commercial and consumer loans Home mortgages Allowance for loan losses Premises and equipment Goodwill Other assets Total 20 20 2,000 9,500 60,000 36,000 (2,800) 4,000 3,500 1.800 $135,500 100 50 0 100 0 100 Total $135,500 (3) Interstate Bank has $100 million of total assets and $8 million of equity capital. The bank has paid 40 percent of net income after taxes as dividends to shareholders in the past, and this is expected to continue in the foreseeable future. (a) What ROA must be achieved to support a 12% growth in assets? (b) If an ROA of only 0.99% seems feasible, what will the dividend payout ratio have to be to support a 12% asset growth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts