Question: 2. Excel Online Structured Activity: New project analysis You must evaluate the purchase of a proposed spectrometer for the R&D department. The base price is

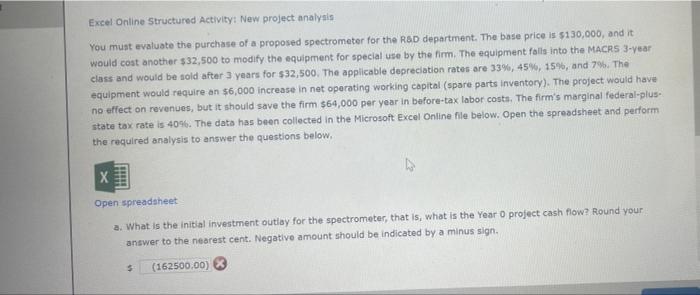

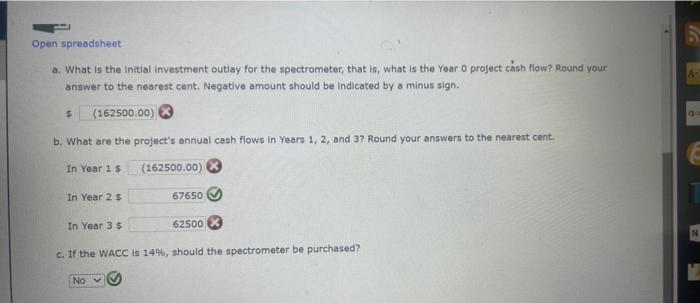

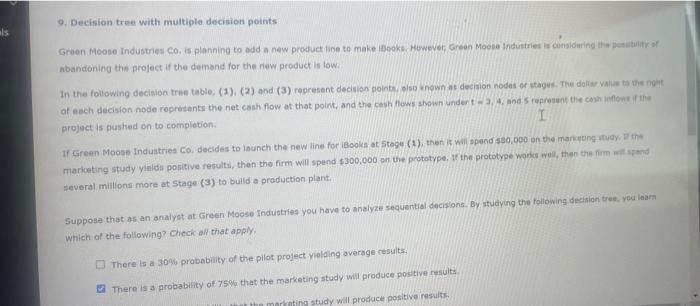

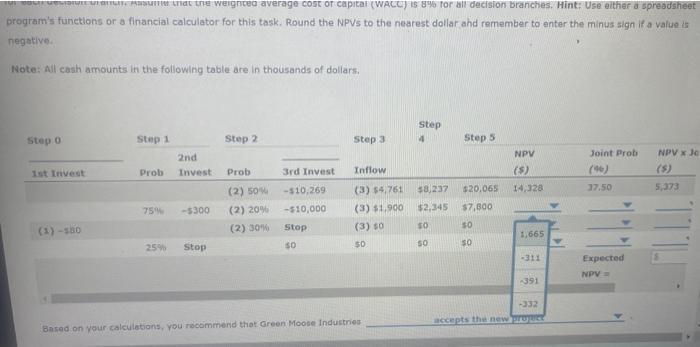

Excel Online Structured Activity: New project analysis You must evaluate the purchase of a proposed spectrometer for the R&D department. The base price is $130,000, and it would cost another $32,500 to modify the equipment for special use by the firm. The equipment falls into the MACRS 3-year class and would be sold after 3 years for $32,500. The applicable depreciation rates are 33%, 45%, 15%, and 7%. The equipment would require an $6,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $64,000 per year in before-tax labor costs. The firm's marginal federal-plus- state tax rate is 40%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below, X Open spreadsheet a. What is the initial investment outlay for the spectrometer, that is, what is the Year O project cash flow? Round your answer to the nearest cent. Negative amount should be indicated by a minus sign, 5 (162500,00) Open spreadsheet A a. What is the initial investment outlay for the spectrometer, that is what is the Year o project cash flow? Round your answer to the nearest cent. Negative amount should be indicated by a minus sign. (162500.00) 5 b. What are the project's annual cash flows in Years 1, 2, and 3? Round your answers to the nearest cent In Year 1$ (162500.00) In Year 25 67650 In Year 3 $ 62500 c. If the WACC is 14%, should the spectrometer be purchased? No 9. Decision tree with multiple decision points els Green Moone Industries Co. is planning to add a new product line to make it ook. However, Green Moone Industries is considering the buty of abandoning the project if the demand for the new product is low. In the following decision tree table, (1), (2) and (3) represent decision points shown as decision nodes or stages. The dollar value to the not of each decision node represents the net cash flow at that point, and the cash flows shown undert. 4, and represent the cash in the project is pushed on to completion I If Green Moose Industries Co. decides to launch the new line for Books at Stage (1), then it will spend 500,000 on the mancang study the marketing study yields positive results, then the firm will spend $300,000 on the prototype, the prototype work well, then them and several millions more at Stage (3) to build a production plant, Suppose that as an analyst at Green Moose Industries you have to analyze sequential decisions. By studying the following decision to you learn which of the following? Check all that apply There is a 30% probability of the pilot project yielding average results. There is a probability of 75% that the marketing study will produce positive results the metroting study will produce positive results Wat the weighted average cost of capital (WACC) IS 0% for all decision branches. Hint: Use either a spreadsheet program's functions or a financial calculator for this task. Round the NPVs to the nearest dollar and remember to enter the minus sign if a value is negative Note: All cash amounts in the following table are in thousands of dollars, Step 4 Step o Step 1 Step 2 Step 3 Step 5 2nd Invest Joint Prob (16) NPV x Jo (5) 1st Invest Prob Prob NPV (82 14,128 3rd Invest Inflow -$10.269 $20,065 27.50 5,373 754 (2) 50 (2) 209 (2) 30% $8,237 $2,345 -5300 (3) 54,761 (3) $1,900 (3) 50 -$10,000 $7,000 Stop 10 (1) -560 50 1,665 50 SD 50 259 Stop SO -311 Expected NPV 391 -332 accepts the new Based on your calculations, you recommend that Green Moose Industries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts