Question: 2 Excel Problem Show All Excel Work (32 points) DRS is a lid manufacturer that is considering a new project. This project will produce 2,000,000

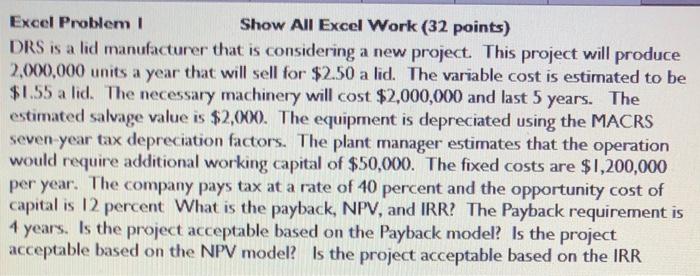

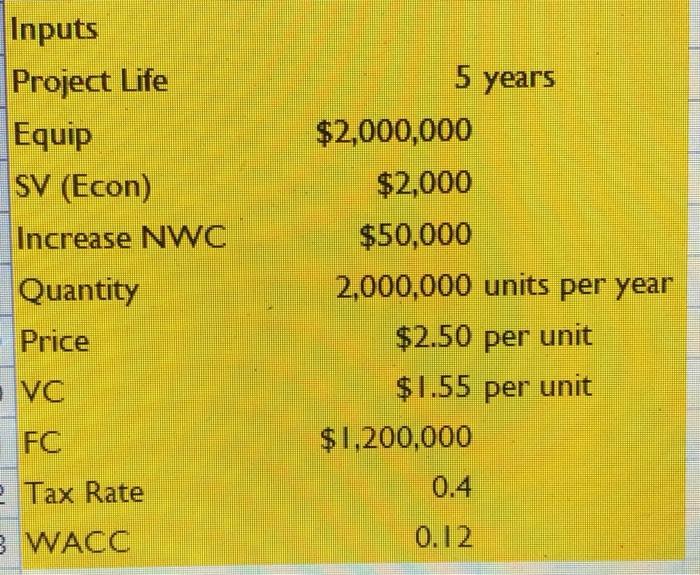

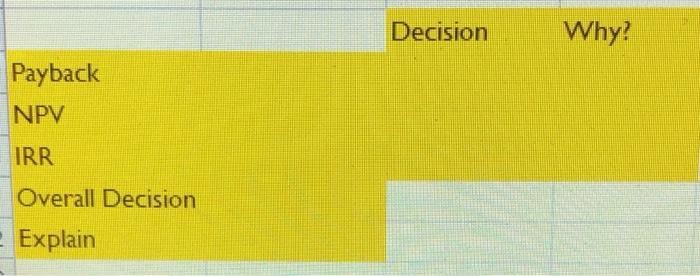

2 Excel Problem Show All Excel Work (32 points) DRS is a lid manufacturer that is considering a new project. This project will produce 2,000,000 units a year that will sell for $2.50 a lid. The variable cost is estimated to be $1.55 a lid. The necessary machinery will cost $2,000,000 and last 5 years. The estimated salvage value is $2,000. The equipment is depreciated using the MACRS seven year tax depreciation factors. The plant manager estimates that the operation would require additional working capital of $50,000. The fixed costs are $1,200,000 per year. The company pays tax at a rate of 40 percent and the opportunity cost of capital is 12 percent What is the payback, NPV, and IRR? The Payback requirement is 4 years. Is the project acceptable based on the Payback model? Is the project acceptable based on the NPV model? Is the project acceptable based on the IRR 5 years Inputs Project Life Equip SV (Econ) Increase NWC Quantity $2,000,000 $2,000 $50,000 2,000,000 units per year $2.50 per unit $1.55 per unit $1,200,000 Price VC FC 2 Tax Rate 0.4 3 WACC 0.12 Decision Why? Payback NPV IRR Overall Decision - Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts