Question: 2) Execution (12 points) A portfolio manager makes a decision to buy 5,000 shares of Sumatra Natural Resources at 10:00 a.m, when the price was

2) Execution (12 points)

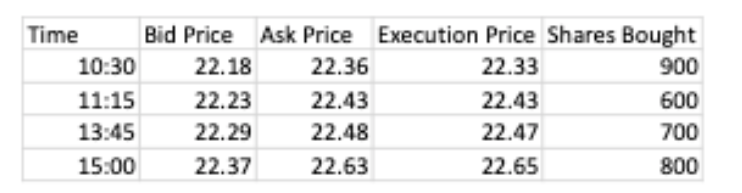

A portfolio manager makes a decision to buy 5,000 shares of Sumatra Natural Resources at 10:00 a.m, when the price was 22.36. The following are snapshots of the trades made during that time.

The closing price for the day was the portfolio managers last trade at 22.65, at which point the order for the remaining 2,000 shares was cancelled. Calculate the following:

i) What is the average effective spread (Hint: you know how to calculate all the individual spreads) (3 pts):

ii) Assume that the trades listed are the only ones executed that day in Sumatra. What is the VWAP? (1 pts)

iii) Assume that total commissions paid were $210 for the 3,000 shares purchased. Calculate the implementation shortfall (5 pts):

iv) Calculate the explicit costs (1 pts)

v) What would be the argument for implementation shortfall over VWAP? (2 pts)

Time Bid Price Ask Price 10:30 11:15 13:45 15:00 22.18 22.23 22.29 22.37 22.36 22.43 22.48 22.63 Execution Price Shares Bought 900 600 700 800 22.33 22.43 22.47 22.65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts