Question: Using some financial resource, find an option chain for a public equity with a market capitalization greater than USD 1 billion. Choose one of those

- Using some financial resource, find an option chain for a public equity with a market capitalization greater than USD 1 billion. Choose one of those options and take a screen shot. Tell me the following details (5 pts):

- Expiration date

- Strike price

- Type of option

- Current Bid/Offer

A point for each detail provided, 1 point for screenshot.

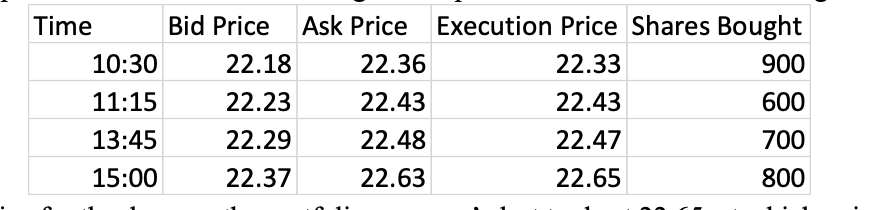

- A portfolio manager makes a decision to buy 5,000 shares of Sumatra Natural Resources at 10:00 a.m, when the price was 22.36. The following are snapshots of the trades made during that time.

Time Bid Price Ask Price Execution Price Shares Bought

10:30 22.18 22.36 22.33 900 11:15 22.23 22.43 22.43 600 13:45 22.29 22.48 22.47 700 15:00 22.37 22.63 22.65 800

The closing price for the day was the portfolio managers last trade at 22.65, at which point the order for the remaining 2,000 shares was cancelled. Calculate the following:

What is the average effective spread (Hint: you know how to calculate all the individual spreads) (4 pts):

Time Bid Price Ask Price Execution Price Shares Bought 10:30 22.18 22.36 22.33 900 11:15 22.23 22.43 22.43 600 13:45 22.29 22.48 22.47 700 15:00 22.37 22.63 22.65 800 Time Bid Price Ask Price Execution Price Shares Bought 10:30 22.18 22.36 22.33 900 11:15 22.23 22.43 22.43 600 13:45 22.29 22.48 22.47 700 15:00 22.37 22.63 22.65 800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts