Question: 2 expert already answer this question bt both are diferent i m shocked because cheeg have a top expert so why every expert answr to

2 expert already answer this question bt both are diferent i m shocked because cheeg have a top expert so why every expert answr to me diferent? plz if you are best expert in finance so plz solve this question acurately and surity thanks

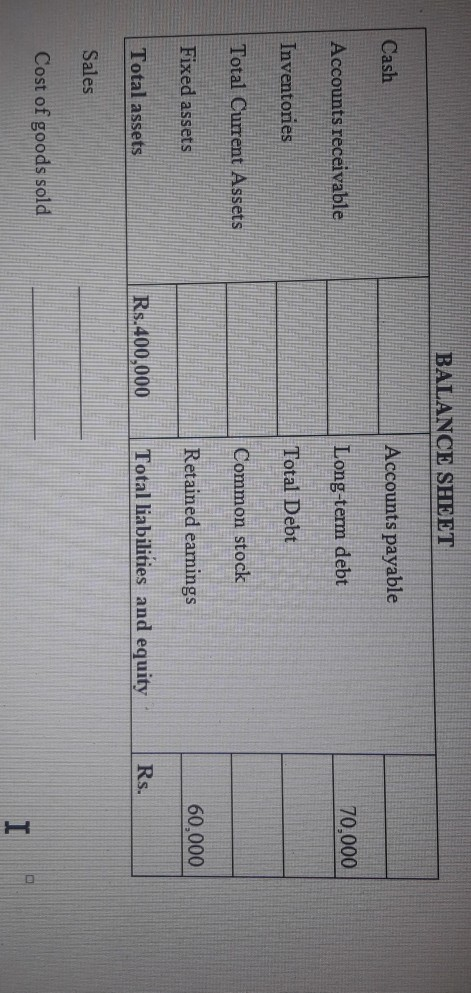

2. Complete the balance sheet and sales information of M/s. Stockiest using the following financial data: (Marks-2) Debt ratio 40% Quick ratio: 0.35 times Total assets tumover: 1.95 times Receivable Tumover in days 8 days (Calculation is based on a 360-day year.) Gross profit margin 35% Inventory tumover ratio: 6.5 times BALANCE SHEET Cash Accounts payable Accounts receivable Long-term debt 70,000 Inventories Total Debt Total Current Assets Common stock Fixed assets Retained earings 60,000 Total assets Rs.400,000 Total liabilities and equity Rs. Sales Cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts