Question: 2. Explain the difference between Beta and the correlation. Do they provide the same information? Can both be negative? 3. On the CAPM, explain: a.

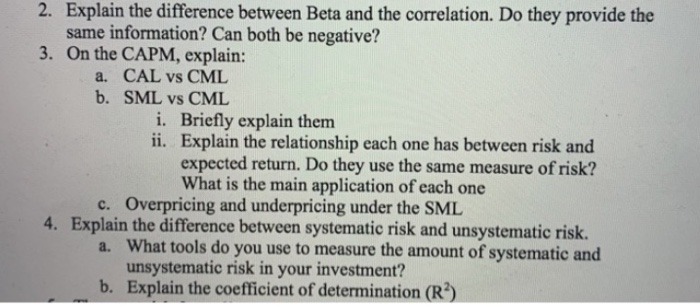

2. Explain the difference between Beta and the correlation. Do they provide the same information? Can both be negative? 3. On the CAPM, explain: a. CAL vs CML b. SML vs CML i. Briefly explain them ii. Explain the relationship each one has between risk and expected return. Do they use the same measure of risk? What is the main application of each one c. Overpricing and underpricing under the SML 4. Explain the difference between systematic risk and unsystematic risk. a. What tools do you use to measure the amount of systematic and unsystematic risk in your investment? b. Explain the coefficient of determination (R)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts