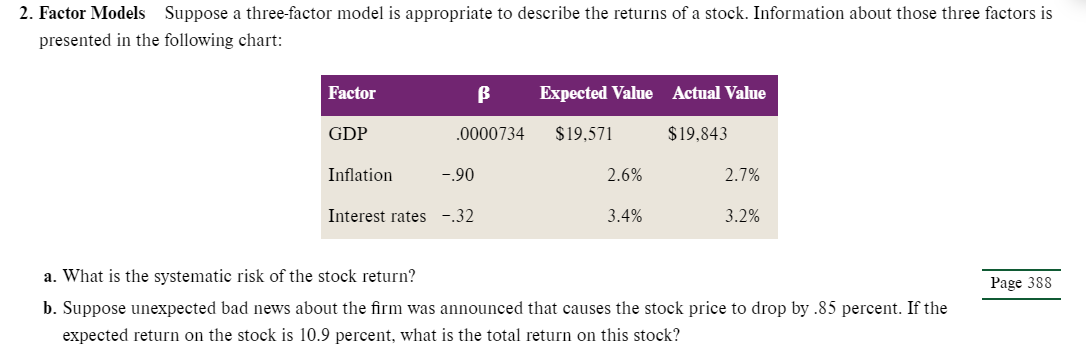

Question: 2. Factor Models Suppose a three-factor model is appropriate to describe the returns of a stock. Information about those three factors is presented in the

2. Factor Models Suppose a three-factor model is appropriate to describe the returns of a stock. Information about those three factors is presented in the following chart: Factor B Expected Value Actual Value GDP .0000734 $19,571 $19,843 Inflation -.90 2.6% 2.7% Interest rates -.32 3.4% 3.2% Page 388 a. What is the systematic risk of the stock return? b. Suppose unexpected bad news about the firm was announced that causes the stock price to drop by.85 percent. If the expected return on the stock is 10.9 percent, what is the total return on this stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts