Question: 2. Fill out the table provided below using the formula for the weighted average cost of debt and equity capital for alternative leverage positions. Find

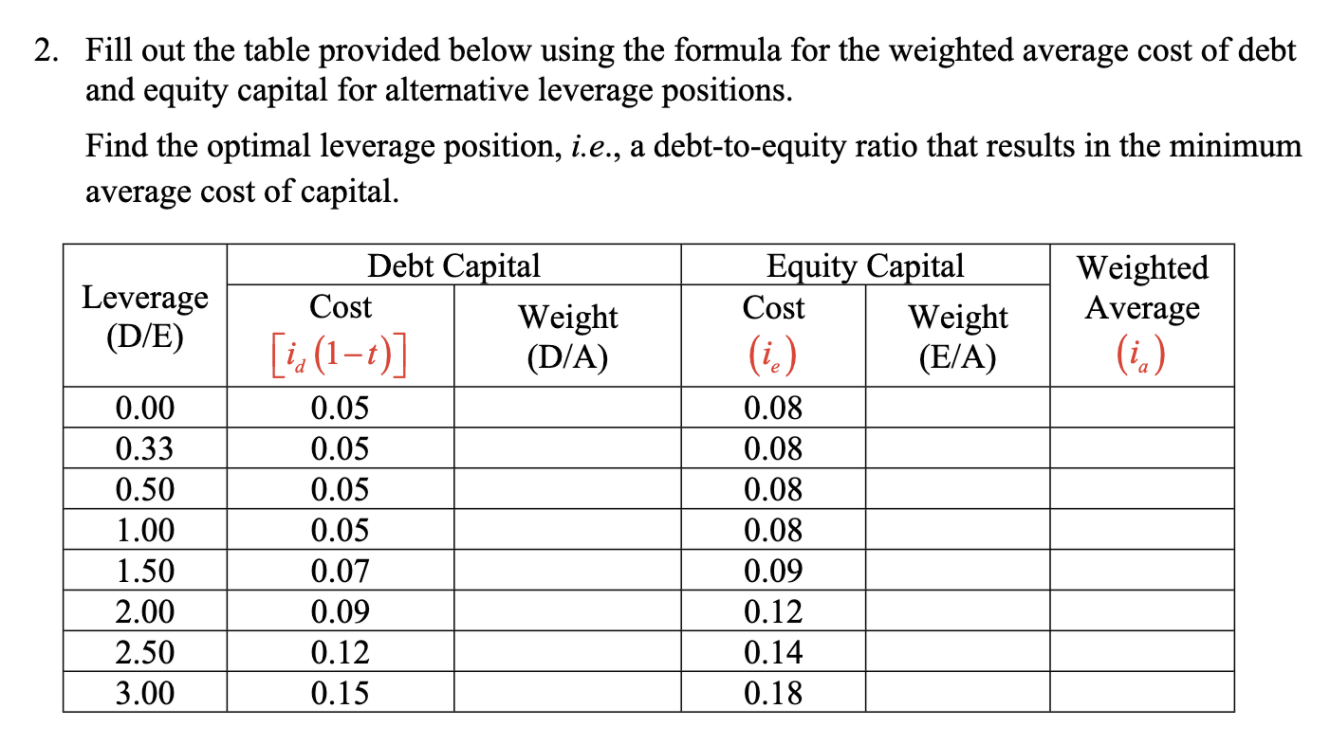

2. Fill out the table provided below using the formula for the weighted average cost of debt and equity capital for alternative leverage positions. Find the optimal leverage position, i.e., a debt-to-equity ratio that results in the minimum average cost of capital. Leverage (D/E) Weighted Average (i.) 0.00 0.33 0.50 1.00 1.50 2.00 2.50 3.00 Debt Capital Cost Weight [ia (1t) (D/A) 0.05 0.05 0.05 0.05 0.07 0.09 0.12 0.15 Equity Capital Cost Weight (i.) (E/A) 0.08 0.08 0.08 0.08 0.09 0.12 0.14 0.18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts