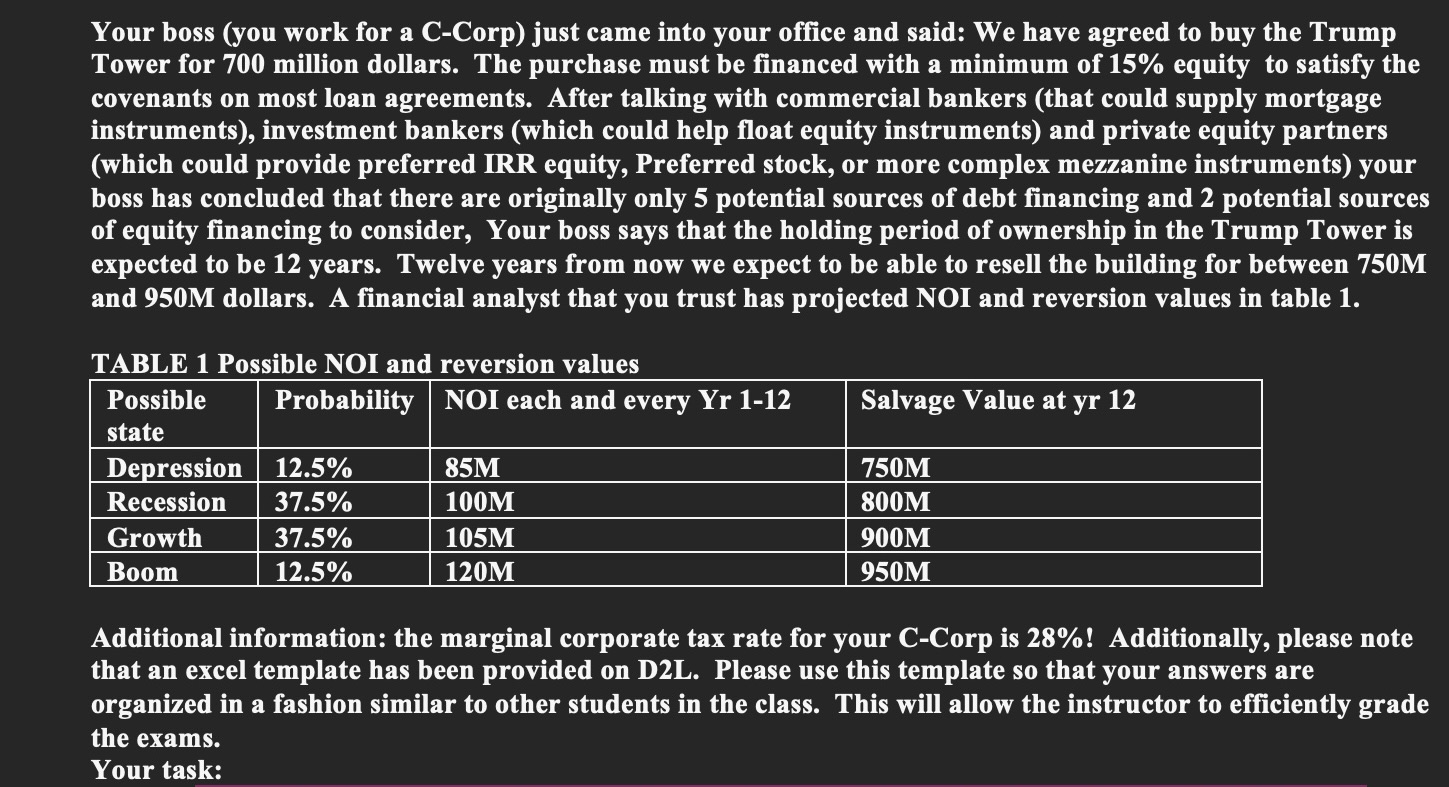

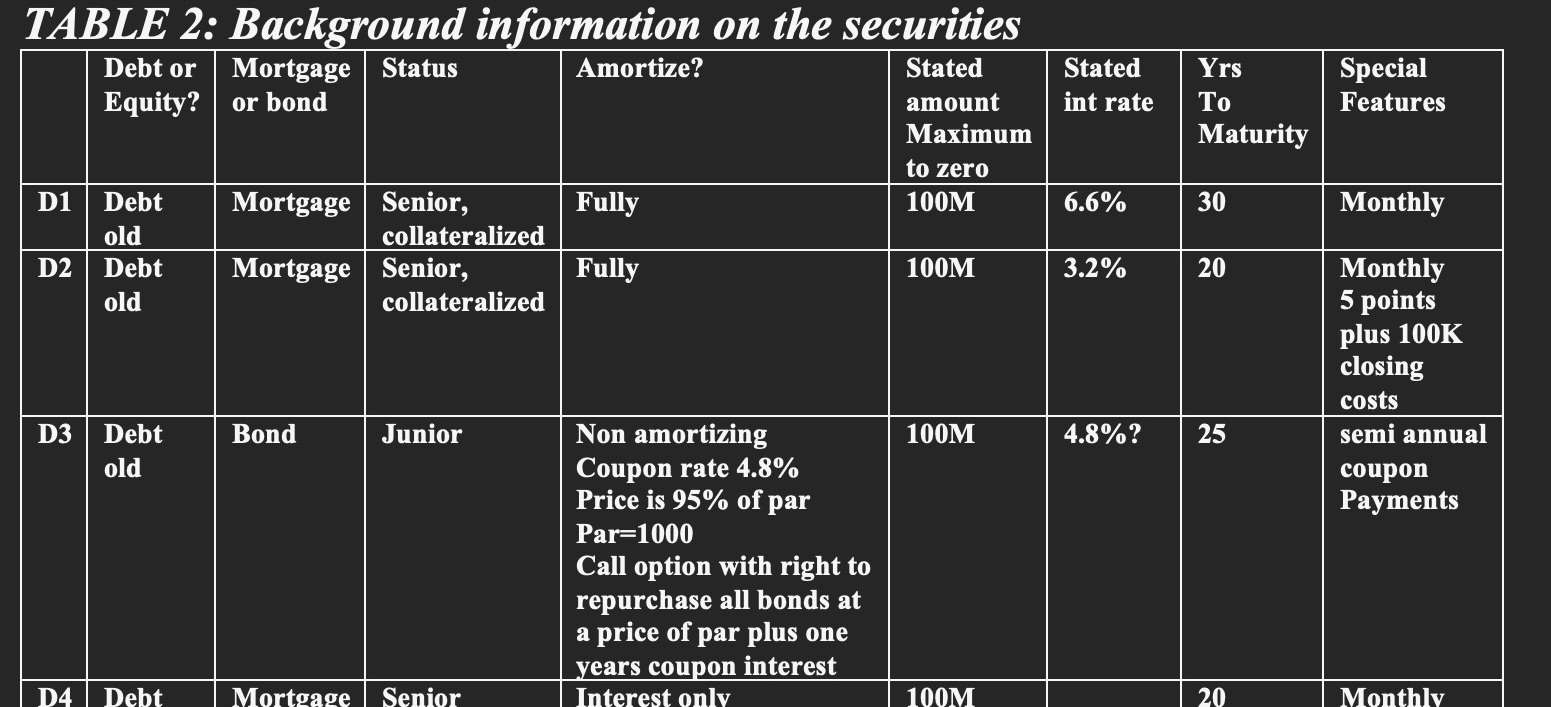

Question: Use the documents given to only solve for Debt 3 in table 2 what we know: Bond $100,000,000 Interest 4.80% Term 25 Coupon Rate 4.80%

Use the documents given to only solve for Debt 3 in table 2

what we know:

| Bond | $100,000,000 |

| Interest | 4.80% |

| Term | 25 |

| Coupon Rate | 4.80% |

| Par | $1,000 |

| Bond Price | $950.00 |

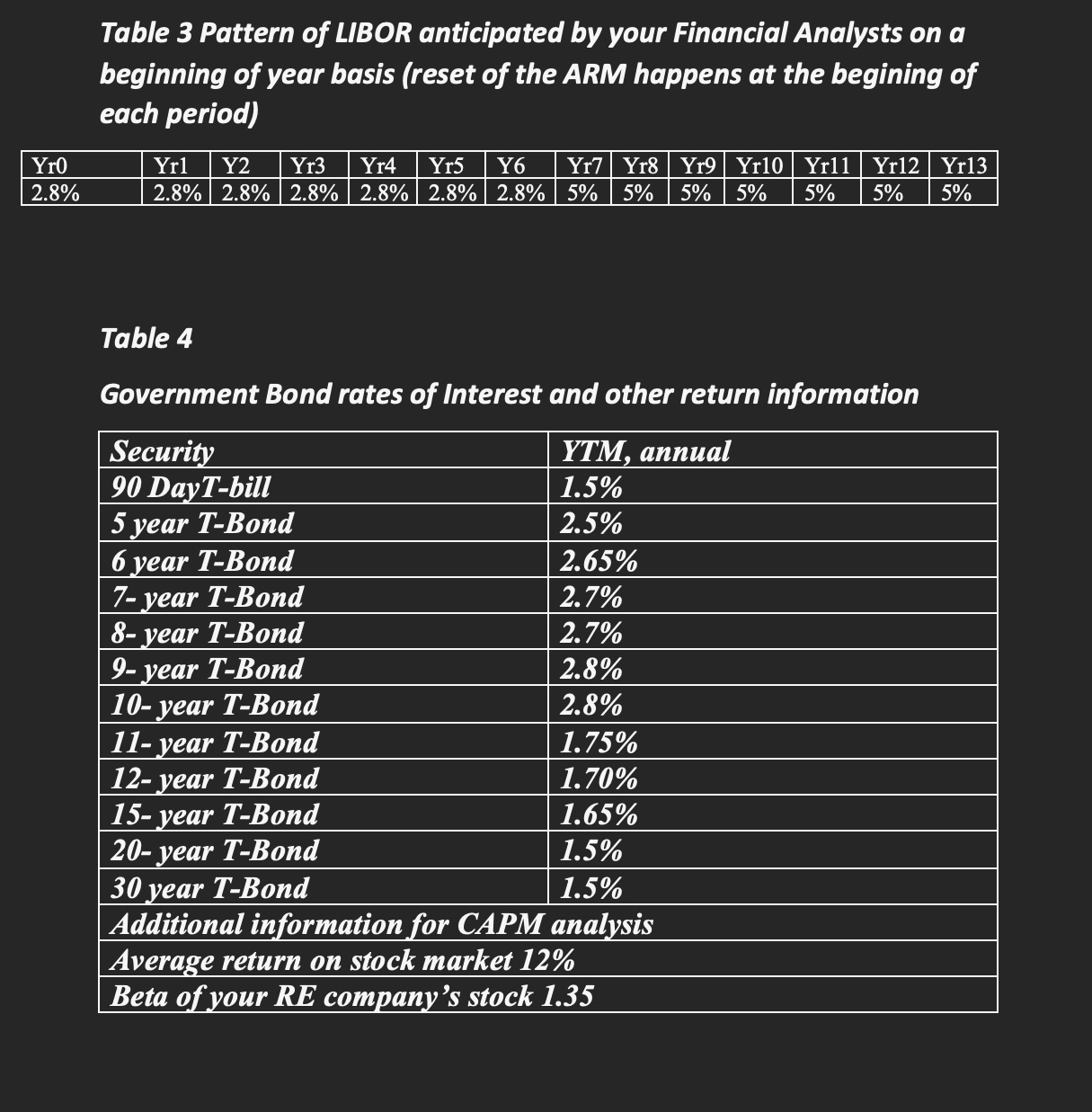

- Suggest the "best" means to finance the project, that is determine the optimal capital stack, i.e. minimize the weighted average cost of capital To find this please find the effective annual cost of capital from each debt and equity source. (only do debt 3) find the following for debt 3

| Coupon Payment |

| Annual Coupon Payment |

| Yr 12 Balance |

| Calculated Rate |

| Effective Cost |

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock