Question: #2 FIRE 371 1) Olay Co. has $3mi net operating working capital and $30 mi net fixed assets. It has sales of $35mi, costs of

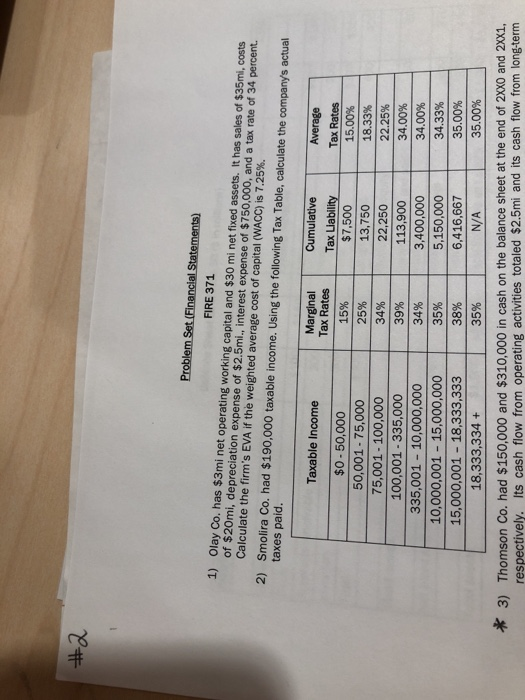

FIRE 371 1) Olay Co. has $3mi net operating working capital and $30 mi net fixed assets. It has sales of $35mi, costs of $20mi, depreciation expense of $2.5mi., interest expense of $750,000, and a tax rate of 34 percent. Calculate the firm's EVA if the weighted average cost of capital (WACC) is 7.25%. Smolira Co. had $190,000 taxable income. Using the following Tax Table, calculate the company's actual taxes paid. 2) MarginalCumulative Tax Rates Average Taxable Income $0-50,000 50,001-75,000 75,001-100,000 100,001- 335,000 335,001 - 10,000,000 10,000,001-15,000,000 15,000,001 -18,333,333 18,333,334 + Tax Liability $7,500 13,750 22,250 113,900 3,400,000 5,150,000 Tax Rates 15% 25% 34% 39% 34% 15.00% 18.33% 22.25% 34.00% 34.00% 34.33% 35.00% 35.00% 38% | 6,416,667 35% N/A 3) Thomson Co. had $150,000 and $310,000 in cash on the balance sheet at the end of 2xxo and 2xx1, respectively. Its cash flow from operating activities totaled $2.5mi and its cash flow from long-term

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts